Accounting Module

The Accounting Module provides a comprehensive accounting solution with an extensive collection of transaction processing applets designed to handle every aspect of financial operations. This module goes beyond basic financial accounting to offer specialized transaction processing capabilities for complex business scenarios.

Overview

The Accounting Module delivers:

- Complete Transaction Processing - Extensive collection of specialized transaction applets

- Advanced Financial Operations - Beyond basic accounting to complex financial workflows

- Specialized Industry Support - Transaction applets tailored for specific industries

- Integrated Workflow Management - Seamless transaction processing workflows

- Comprehensive Audit Trails - Complete transaction tracking and compliance

Core Accounting Foundation Applets

1. General Ledger Applet

Purpose: Central accounting engine for all financial transactions

- Double-entry bookkeeping

- Multi-currency support

- Real-time balance calculations

- Period-end processing

- Comprehensive audit trails

Used by: Finance teams and accounting staff Documentation: TODO: General Ledger Applet - Documentation pending

2. Chart of Accounts Management Applet

Purpose: Advanced chart of accounts configuration and management

- Hierarchical account structures

- Multi-dimensional accounting

- Account mapping and consolidation

- Dynamic account creation

- Account lifecycle management

Used by: CFO, Controllers, and accounting managers Documentation: TODO: Chart of Accounts Management Applet - Documentation pending

3. Journal Entry Processing Applet

Purpose: Manual and automated journal entry processing

- Template-based entries

- Recurring journal entries

- Batch processing capabilities

- Approval workflows

- Reversing entries

Used by: Accounting staff and controllers Documentation: TODO: Journal Entry Processing Applet - Documentation pending

Accounts Receivable Transaction Applets

4. Customer Invoice Processing Applet

Purpose: Comprehensive customer invoicing system

- Multi-template invoice generation

- Recurring billing automation

- Pro-forma invoice management

- Credit note processing

- Multi-currency invoicing

Used by: Sales administration and AR teams Documentation: TODO: Customer Invoice Processing Applet - Documentation pending

5. Payment Receipt Processing Applet

Purpose: Customer payment processing and application

- Multiple payment method support

- Partial payment handling

- Payment matching algorithms

- Overpayment management

- Foreign exchange handling

Used by: AR teams and cashiers Documentation: TODO: Payment Receipt Processing Applet - Documentation pending

6. Credit Management Applet

Purpose: Customer credit limit and risk management

- Credit limit administration

- Risk assessment scoring

- Collection workflow automation

- Aging analysis processing

- Bad debt provisioning

Used by: Credit managers and AR teams Documentation: TODO: Credit Management Applet - Documentation pending

Accounts Payable Transaction Applets

7. Vendor Invoice Processing Applet

Purpose: Vendor invoice capture and processing

- OCR invoice scanning

- Three-way matching automation

- Invoice coding and routing

- Approval workflow management

- Dispute resolution tracking

Used by: AP teams and procurement staff Documentation: TODO: Vendor Invoice Processing Applet - Documentation pending

8. Payment Processing Applet

Purpose: Vendor payment processing and disbursement

- Payment run automation

- Multi-bank payment support

- Electronic payment integration

- Check printing capabilities

- Payment reconciliation

Used by: AP teams and treasury staff Documentation: TODO: Payment Processing Applet - Documentation pending

9. Purchase Order Integration Applet

Purpose: Integration between procurement and accounting

- PO-based invoice matching

- Receipt confirmation integration

- Cost center allocation

- Budget integration

- Variance analysis

Used by: Procurement and AP teams Documentation: TODO: Purchase Order Integration Applet - Documentation pending

Cash Management Transaction Applets

10. Bank Reconciliation Applet

Purpose: Automated bank statement reconciliation

- Bank feed integration

- Smart matching algorithms

- Outstanding item tracking

- Multi-bank account support

- Reconciliation reporting

Used by: Treasury and accounting teams Documentation: Bank Reconciliation Applet

11. Cash Flow Management Applet

Purpose: Cash position monitoring and forecasting

- Real-time cash position

- Cash flow forecasting

- Bank account monitoring

- Liquidity management

- Treasury reporting

Used by: Treasury and finance teams Documentation: TODO: Cash Flow Management Applet - Documentation pending

12. Money Market Deposit Applet (Treasury)

Purpose: Money‑market deposit intake, approval, and lifecycle management

- Requisition workflow with invitee emailing on FINAL

- Invitee portal submissions saved to Invitee tab; select Winner

- Interest handling: FIXED or FLOATING (ref value + delta → effective rate)

- Deposit Register finalization auto‑generates placement/interest/maturity transactions

- Auto and manual rollover to create next‑cycle registers (principal only / principal + interest / compound)

- Consistent listings (thousands separators, 2 decimals), SAVE/FINAL parity, full audit trail

Used by: Treasury and Finance Controllers Documentation: Money Market Deposit Applet

13. Petty Cash Management Applet

Purpose: Small cash transaction management

- Cash float management

- Expense reimbursement

- Cash voucher processing

- Reconciliation workflows

- Audit trail maintenance

Used by: Administrative staff and accounting Documentation: TODO: Petty Cash Management Applet - Documentation pending

Asset Management Transaction Applets

14. Fixed Asset Transaction Applet

Purpose: Fixed asset lifecycle transaction processing

- Asset acquisition processing

- Depreciation calculation

- Asset disposal transactions

- Asset transfer processing

- Impairment testing

Used by: Asset managers and accounting teams Documentation: TODO: Fixed Asset Transaction Applet - Documentation pending

15. Inventory Valuation Applet

Purpose: Inventory costing and valuation transactions

- Cost layer management

- Valuation method processing

- Write-down transactions

- Adjustment processing

- Variance analysis

Used by: Cost accountants and inventory managers Documentation: TODO: Inventory Valuation Applet - Documentation pending

Cost Accounting Transaction Applets

16. Cost Center Allocation Applet

Purpose: Cost center and department cost allocation

- Allocation rule processing

- Step-down allocations

- Activity-based costing

- Department recharges

- Profitability analysis

Used by: Cost accountants and managers Documentation: TODO: Cost Center Allocation Applet - Documentation pending

17. Project Cost Tracking Applet

Purpose: Project-based cost accumulation and reporting

- Project cost capture

- Time and expense allocation

- Progress billing

- Project profitability

- Resource utilization

Used by: Project managers and cost accountants Documentation: TODO: Project Cost Tracking Applet - Documentation pending

Tax and Compliance Transaction Applets

18. Tax Transaction Processing Applet

Purpose: Tax calculation and reporting transactions

- Multi-jurisdiction tax processing

- Tax return preparation

- Tax payment processing

- Compliance reporting

- Audit support

Used by: Tax professionals and compliance teams Documentation: TODO: Tax Transaction Processing Applet - Documentation pending

19. Regulatory Reporting Applet

Purpose: Statutory and regulatory report generation

- Financial statement preparation

- Regulatory filing support

- Compliance dashboard

- Report automation

- Audit trail management

Used by: Controllers and compliance teams Documentation: TODO: Regulatory Reporting Applet - Documentation pending

Inter-Company Transaction Applets

20. Inter-Company Transaction Processing Applet

Purpose: Multi-entity transaction processing and elimination

- Inter-company billing

- Transfer pricing

- Elimination entries

- Consolidation support

- Currency translation

Used by: Corporate accounting teams Documentation: TODO: Inter-Company Transaction Processing Applet - Documentation pending

21. Consolidation Processing Applet

Purpose: Multi-entity financial consolidation

- Automated consolidation

- Minority interest calculation

- Goodwill processing

- Consolidation adjustments

- Consolidated reporting

Used by: Corporate controllers and analysts Documentation: TODO: Consolidation Processing Applet - Documentation pending

Budgeting and Planning Transaction Applets

22. Budget Transaction Processing Applet

Purpose: Budget creation, management, and variance processing

- Budget preparation workflows

- Version control management

- Variance analysis processing

- Budget revision tracking

- Performance reporting

Used by: Budget analysts and managers Documentation: TODO: Budget Transaction Processing Applet - Documentation pending

23. Forecast Processing Applet

Purpose: Financial forecasting and planning transactions

- Rolling forecasts

- Scenario planning

- Predictive analytics

- Trend analysis

- Planning workflows

Used by: Financial planning teams Documentation: TODO: Forecast Processing Applet - Documentation pending

Advanced Financial Transaction Applets

24. Foreign Exchange Transaction Applet

Purpose: Multi-currency transaction processing and hedging

- Currency conversion processing

- Hedge accounting

- Translation adjustments

- Exchange rate management

- FX gain/loss processing

Used by: Treasury and international accounting teams Documentation: TODO: Foreign Exchange Transaction Applet - Documentation pending

25. Revenue Recognition Applet

Purpose: Complex revenue recognition transaction processing

- Multi-element arrangements

- Contract modification handling

- Performance obligation tracking

- Revenue allocation processing

- Compliance with IFRS 15/ASC 606

Used by: Revenue accountants and controllers Documentation: TODO: Revenue Recognition Applet - Documentation pending

26. Lease Accounting Applet

Purpose: Lease transaction processing and compliance

- Lease classification

- Right-of-use asset processing

- Lease liability calculations

- Payment processing

- IFRS 16/ASC 842 compliance

Used by: Lease accountants and compliance teams Documentation: TODO: Lease Accounting Applet - Documentation pending

Shared Core Module Dependencies

This comprehensive Accounting Module leverages all essential Core Module applets:

Master Data Foundation

- Organization Applet - Multi-entity structure

- Customer Maintenance Applet - Customer master data

- Supplier Maintenance Applet - Vendor master data

- Employee Maintenance Applet - Employee records

Configuration Foundation

- Chart of Accounts Applet - Base account structure

- Tax Configuration Applet - Tax setup and compliance

- Cashbook Applet - Payment methods and accounts

- Tenant Admin Applet - System administration

Implementation Approach

Phase 1: Foundation Setup

- Configure all Core Module applets

- Set up Chart of Accounts Management

- Initialize General Ledger

- Configure Journal Entry Processing

Phase 2: Transaction Processing

- Implement AR transaction applets

- Configure AP transaction applets

- Set up cash management applets

- Initialize asset management

Phase 3: Advanced Features

- Configure cost accounting applets

- Implement tax and compliance features

- Set up inter-company processing

- Enable budgeting and planning

Phase 4: Optimization

- Configure advanced financial applets

- Implement industry-specific features

- Set up reporting and analytics

- Optimize performance and workflows

Phase 5: Opening balance

Purpose

The Opening Balance Process is used to bring forward balances from the previous accounting or inventory records into the current system. This process ensures the new system reflects accurate stock, receivables, payables, cash, and ledger balances after the company transitions into the new environment.

Note: Some balances may only be available after the previous period’s transactions are finalized or audited. These can be entered progressively once confirmed.

Overview

Opening balance setup involves transferring existing data for the following areas:

| No. | Area | Purpose | Typical Timing |

|---|---|---|---|

| 1 | Stock Balance | Record item quantities and cost values from previous system | Before go-live |

| 2 | Customer Outstanding | Record unpaid invoices or deposits from customers | After go-live (Disable E-invoice) |

| 3 | Supplier Outstanding | Record unpaid supplier bills or paid deposits | After go-live (Disable E-invoice) |

| 4 | Cashbook Balance | Bring forward bank and cash balances | After bank reconciliation confirmation |

| 5 | General Ledger Balance | Record account balances from balance sheet | After finalized previous months reportings |

Step-by-Step Process

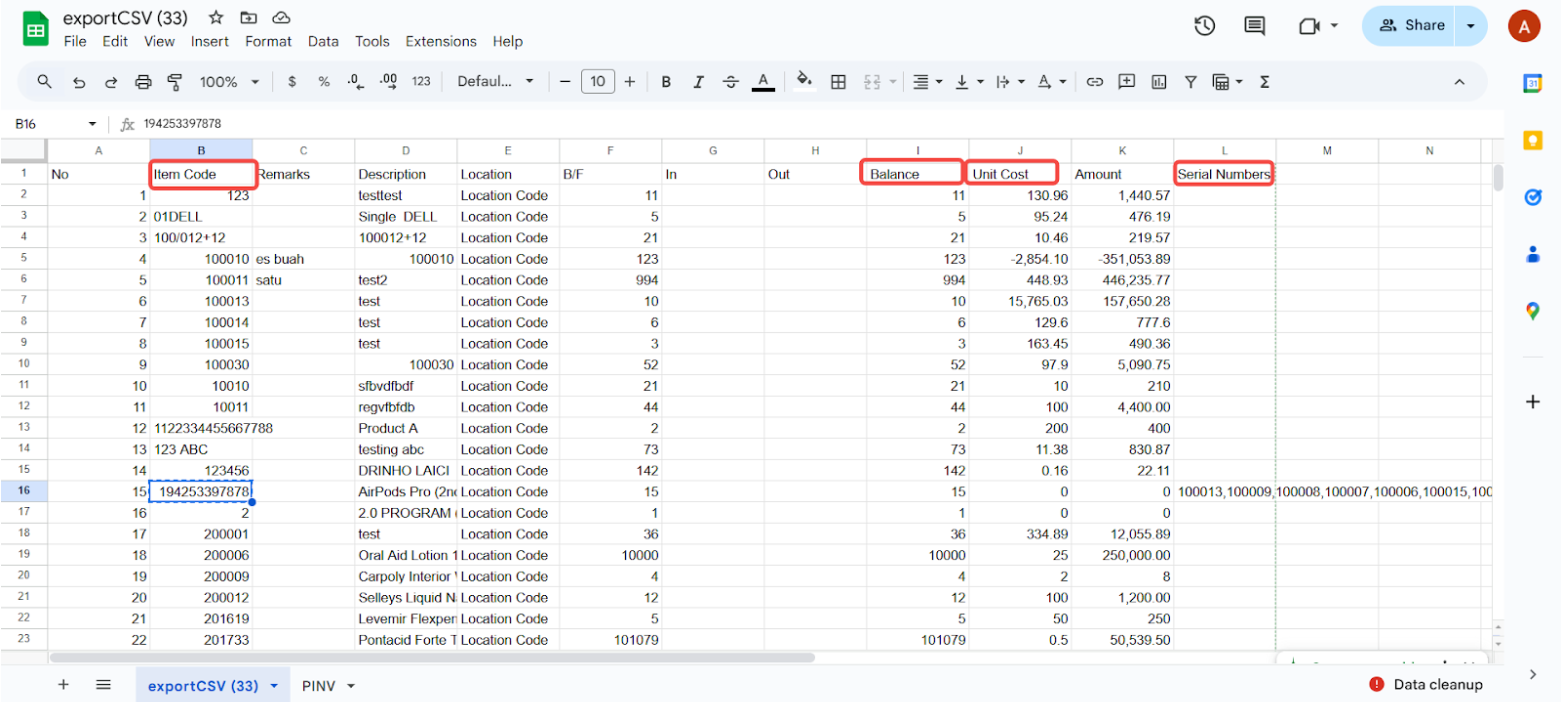

Stock Balance Upload

- Purpose: To import all item quantities and cost values from the old system into the new system before go-live.

- Timing: Perform this process before go-live, after confirming all stock balances from the previous system.

- Preparation:

- Create One time supplier in Supplier Applet

- Export item balance report from old system separately for each branch/location

- Include: Item Code, Description, Quantity, Unit Cost, Total Value, serial number, and branch.

- Ensure item codes are exactly the same between both systems.

- For serialized items, include:

- Serial Number column.

- Number of serial numbers = quantity count.

- Prepare the import file in the system’s purchase invoice template format.

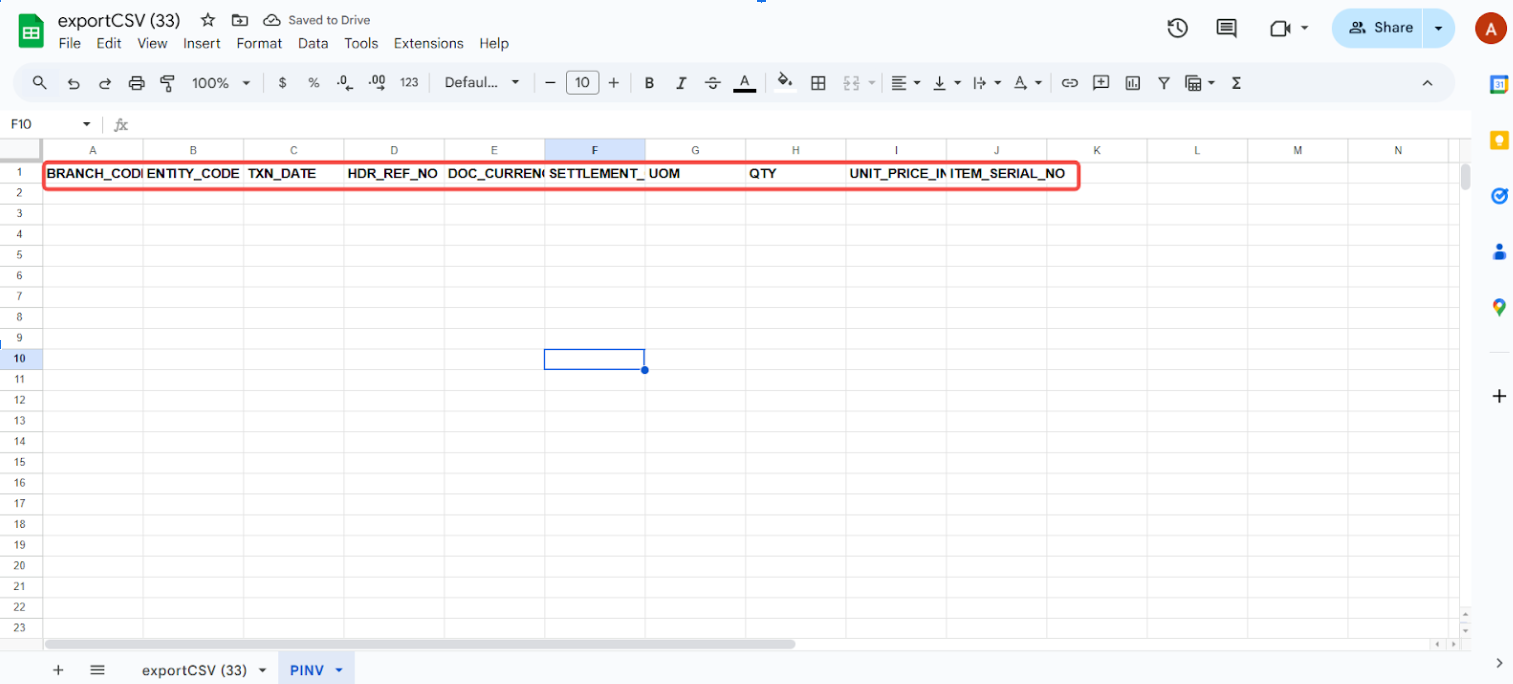

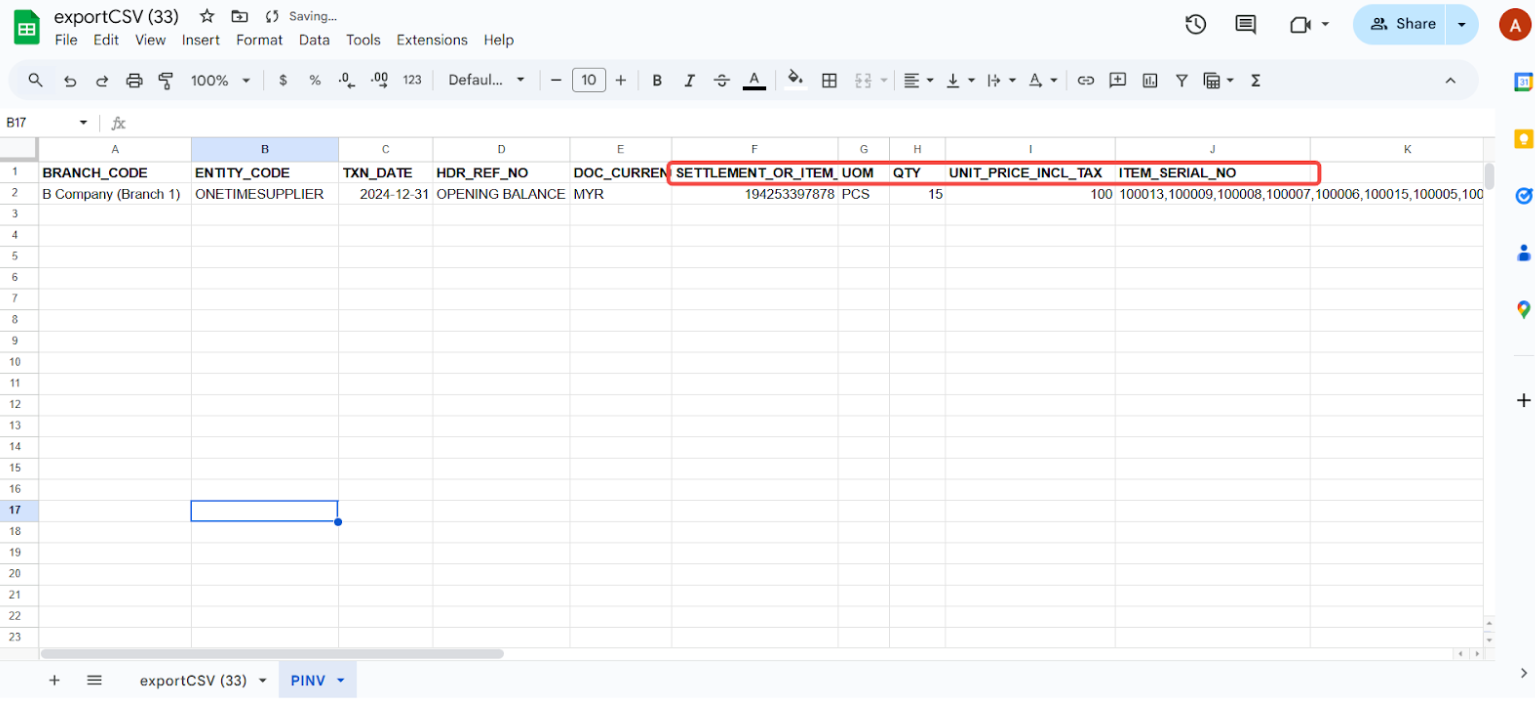

| BRANCH_CODE | ENTITY_CODE | TXN_DATE | HDR_REF_NO | DOC_CURRENCY | SETTLEMENT_OR_ITEM_CODE | UOM | QTY | UNIT_PRICE_INCL_TAX | ITEM_SERIAL_NO |

|---|---|---|---|---|---|---|---|---|---|

Updating of the purchase invoice template

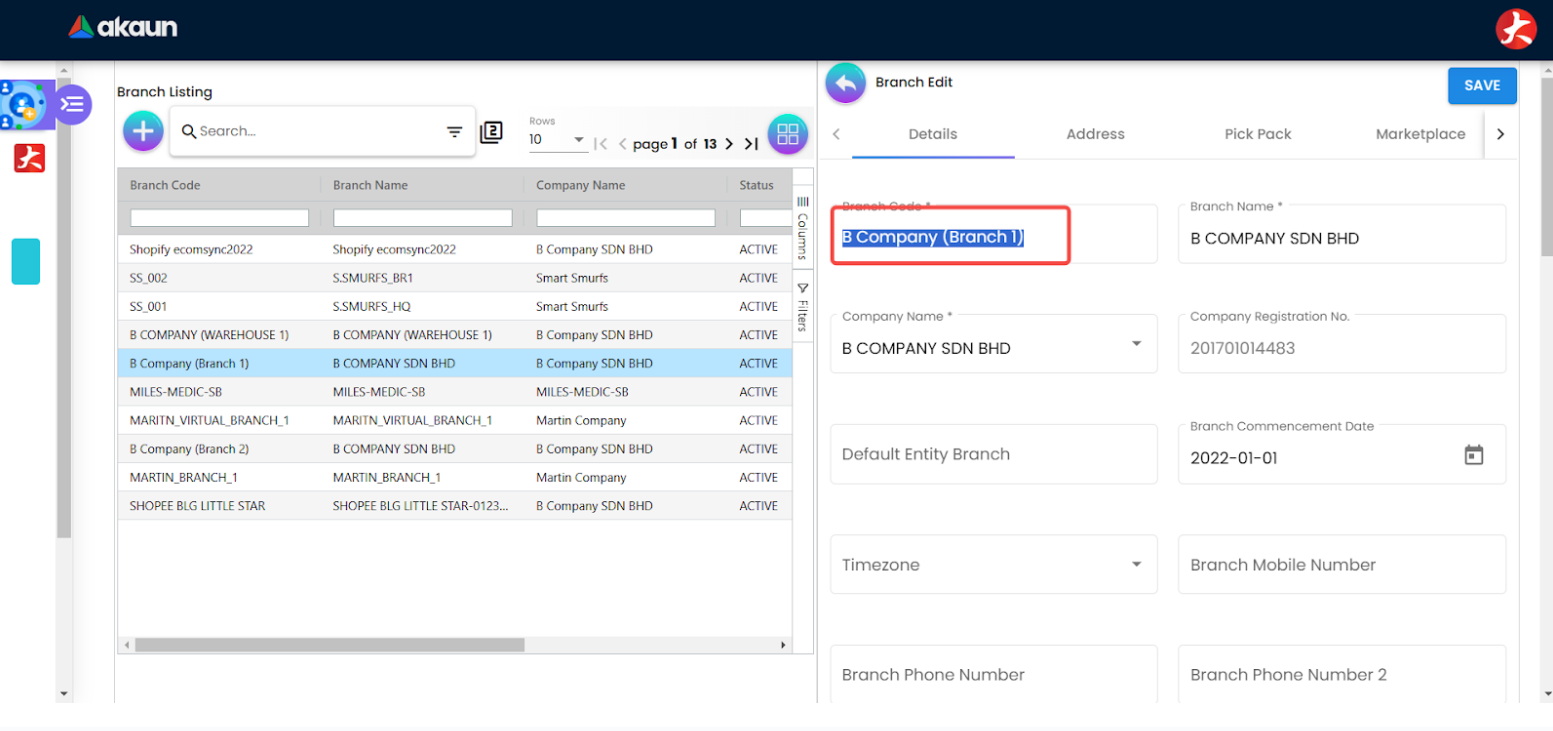

Branch Code, Transaction Date, Currency, HDR Reference and Entity Code:

- Enter the branch code (check the correct branch code from organization applet branch listing)

- Set the transaction date to

2024-12-31. - Put

OPENING BALANCEfor HDR Reference. - Put

MYRfor the currency column. - Put

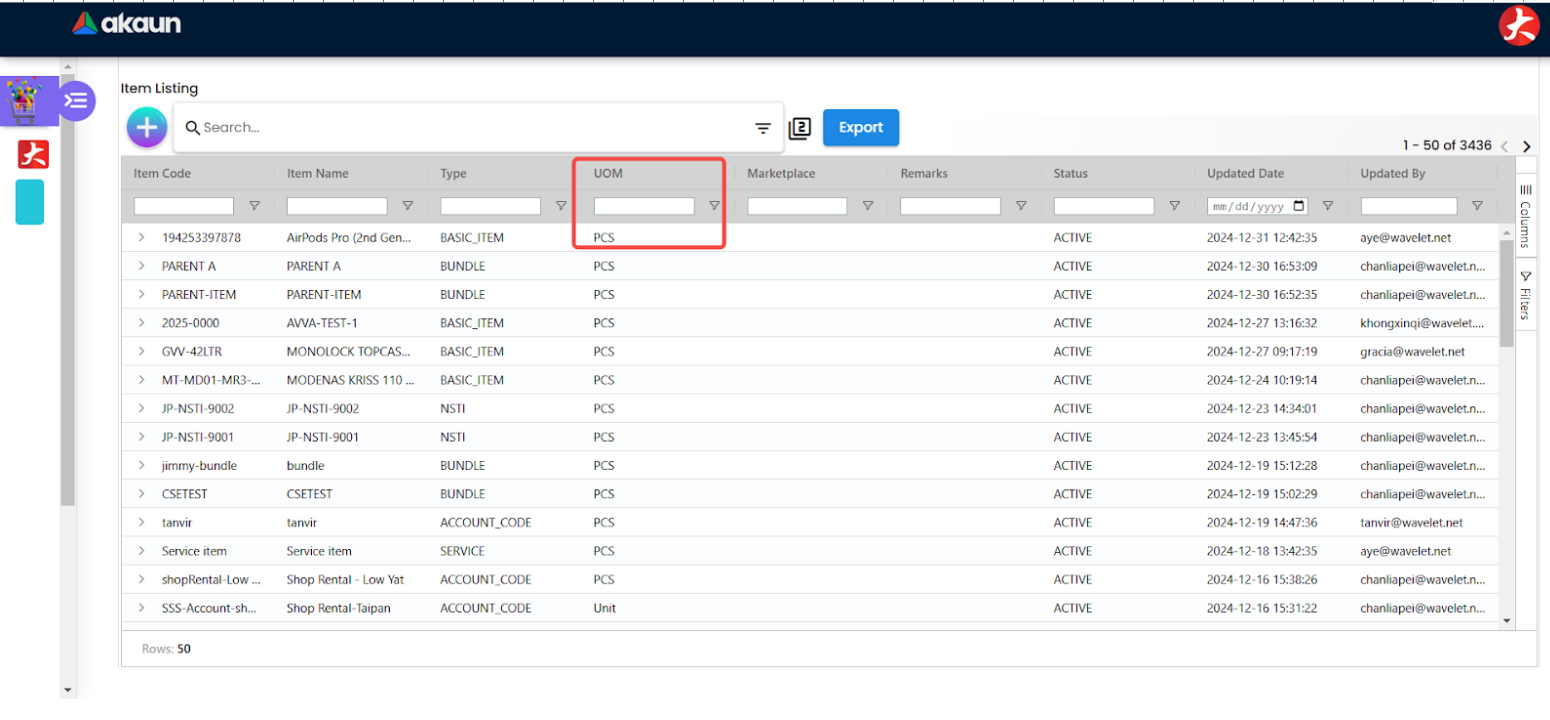

ONE TIME SUPPLIERfor the Entity code (Create theONE TIME SUPPLIERin Supplier Applet First). - Put the UOM based on your Item list in Bigledger (

PCSorUNITor Others).

Item Details:

- Update the following columns copy from old system reports to PINV Template:

- Item Code

- Quantity

- Serial Number - use comma (

,) to separate the serials numbers in one cell - UNIT_PRICE_INCL_TAX

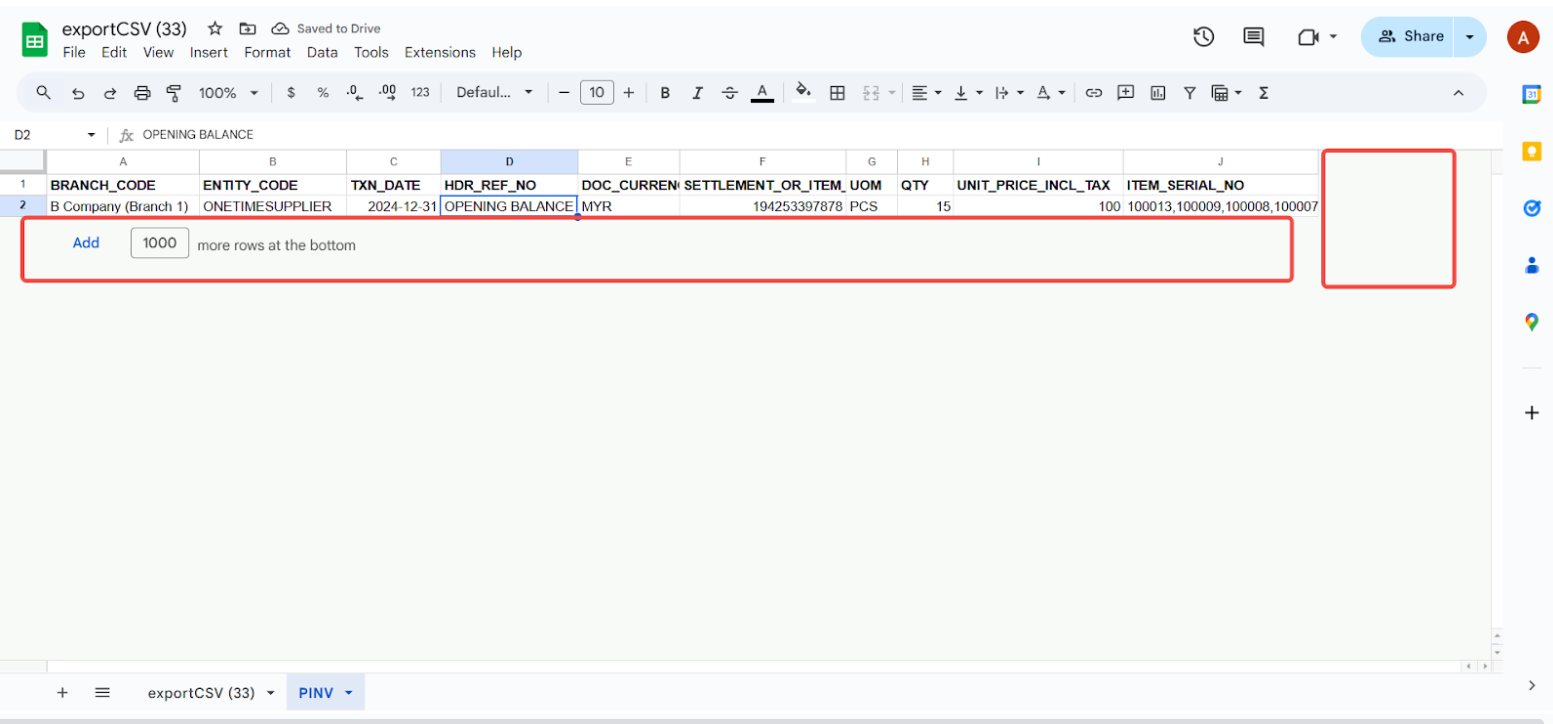

Finalizing the Purchase Invoice upload file

Validate Data:

- Ensure all headers, quantities, costs, and serial numbers are accurate and up to date.

- Extra columns must be deleted.

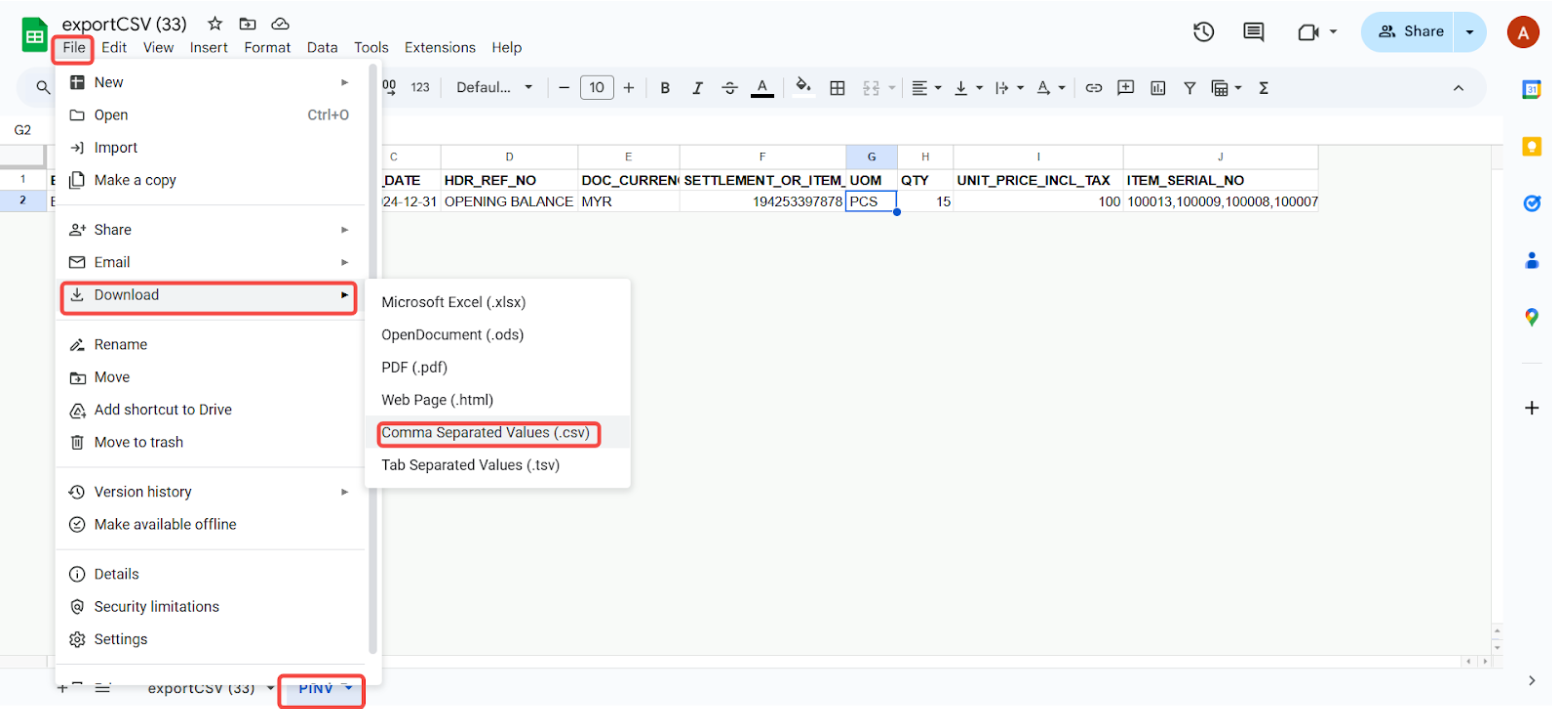

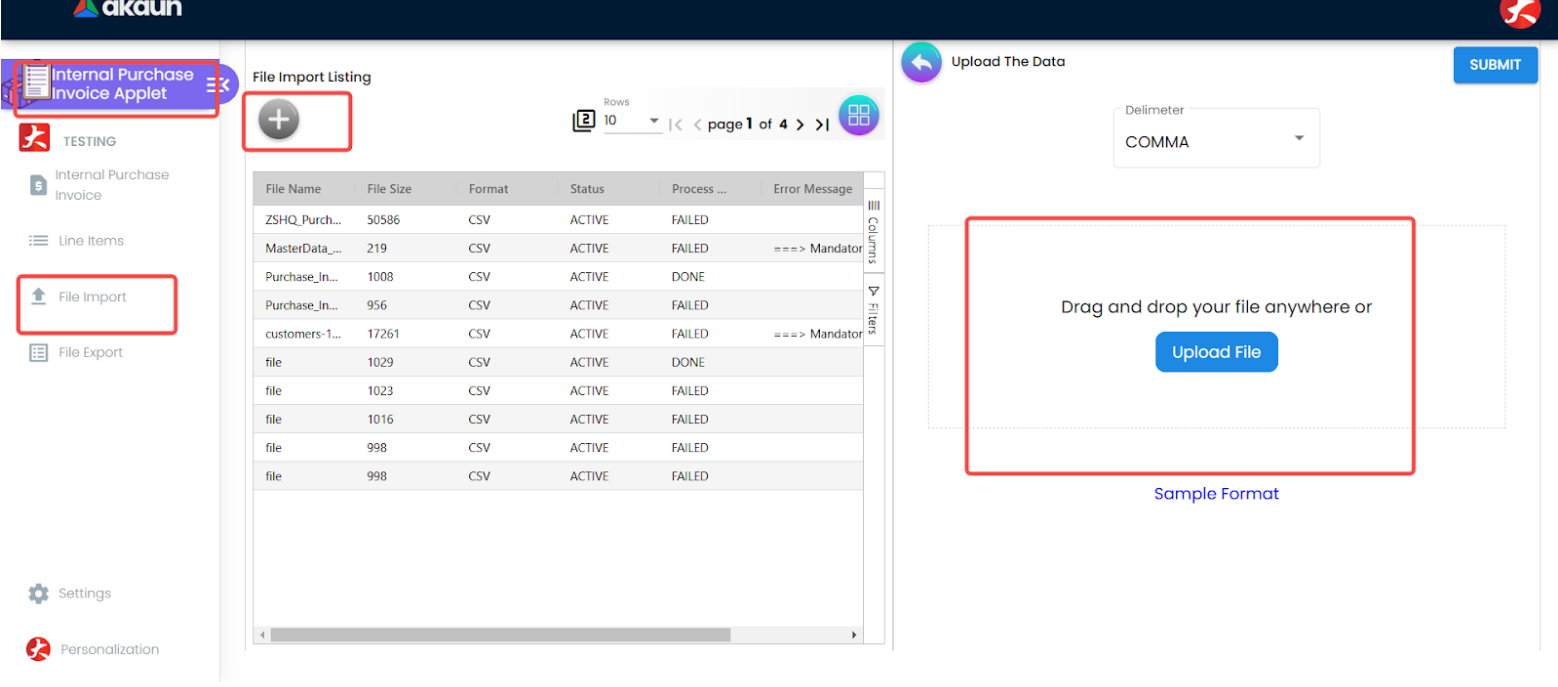

Export and Import to Bigledger

Export as CSV

- Download the updated template as csv

Import to Bigledger

- Open Internal Purchase Invoice Applet

- Click Import File

- Click + button

- Drag or upload the exported csv format file and submit

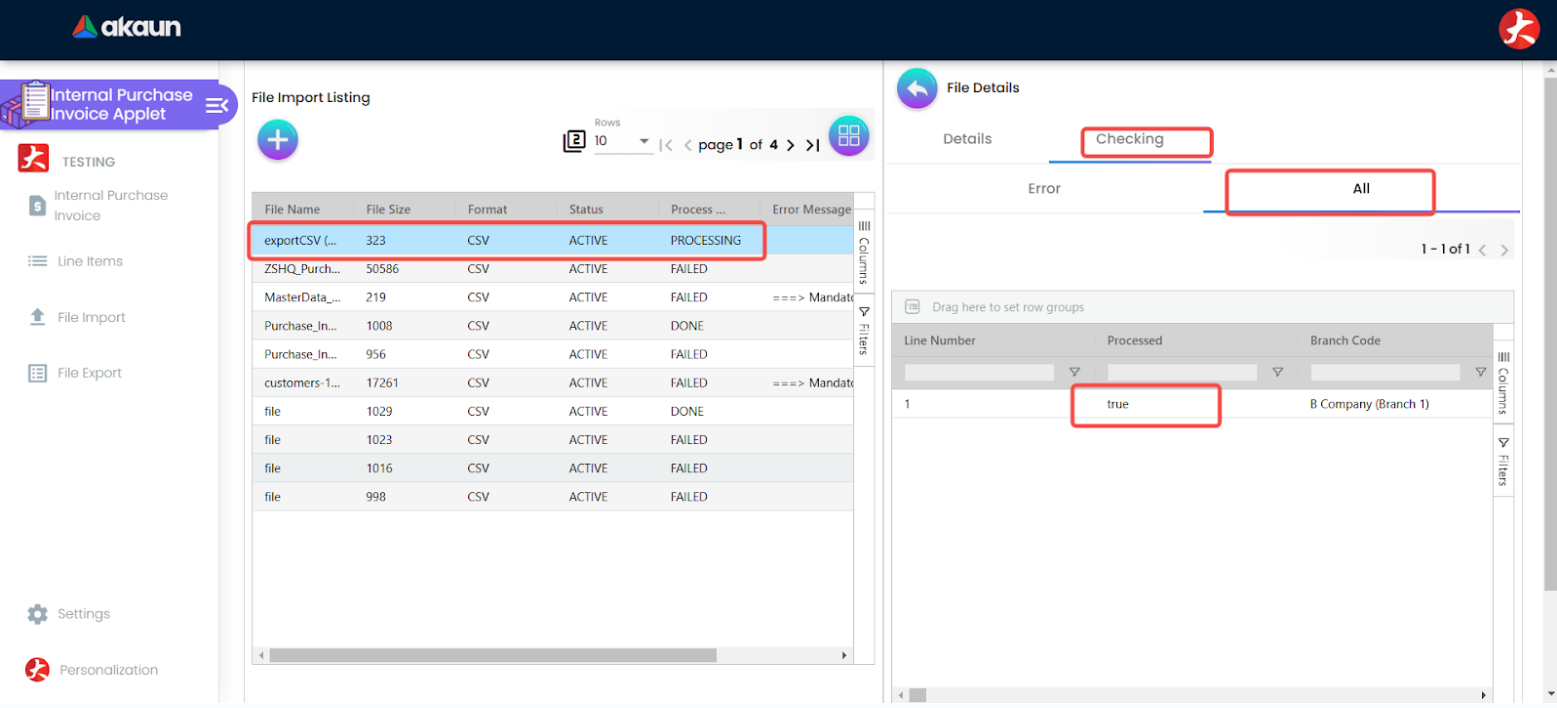

Checking the data

- After upload you may able to check the error by clicking into imported file (true means uploaded, false mean failed, you can scroll to right to check the error msg in red)

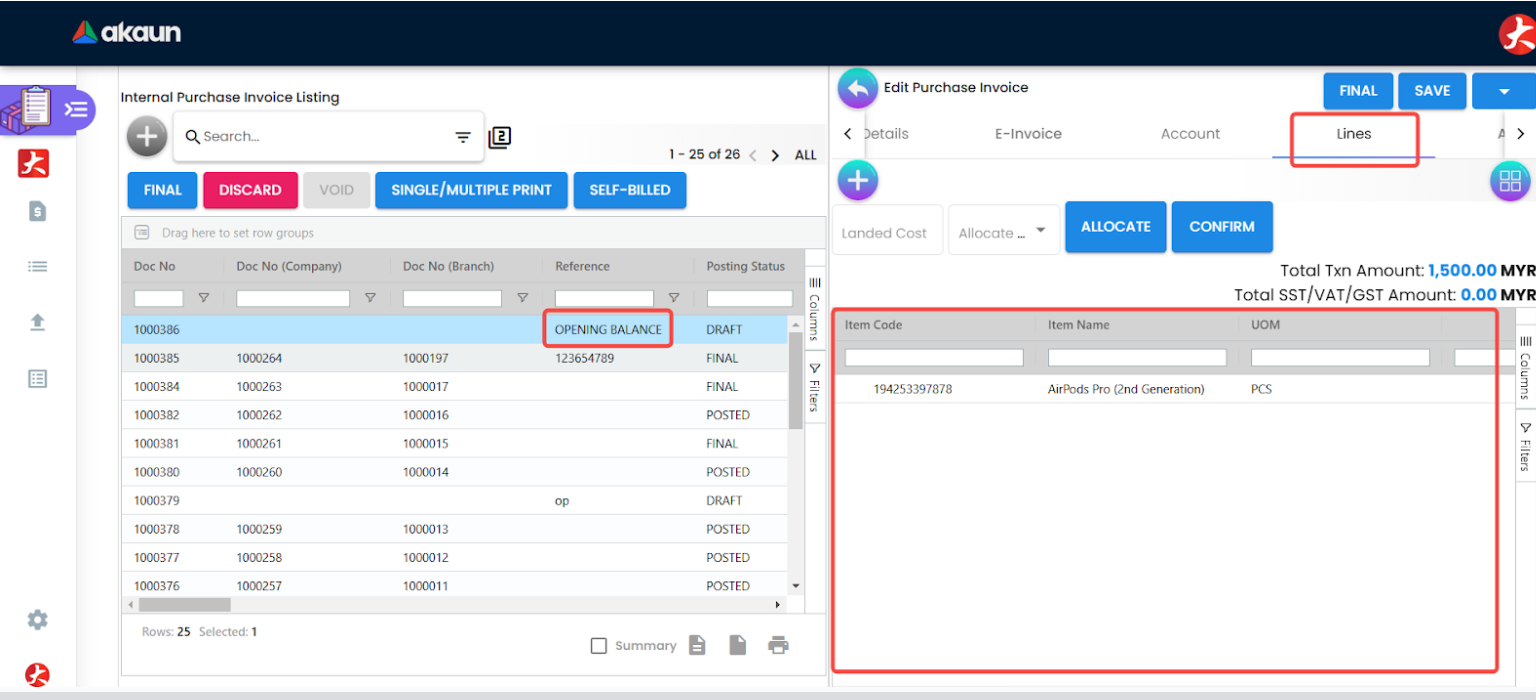

- Open Internal purchase invoice menu, and the uploaded csv file saved as Draft mode

- Click into check the line items details, and FINAL it once confirm

- You can open stock availability report applet to check the stock balance

Common Mistakes to Avoid

- Mismatched item code

- Forgetting to include serial numbers for serialized items.

- Number of serial numbers doesn’t match with item quantity

2. AR Balance (Customer outstanding) Upload

Purpose

The AR Balance Upload process is used to bring forward customer outstanding balances from the previous system into the new system.Their purpose is to ensure that any post-go-live customer payments are correctly applied against prior outstanding balances.

Timing

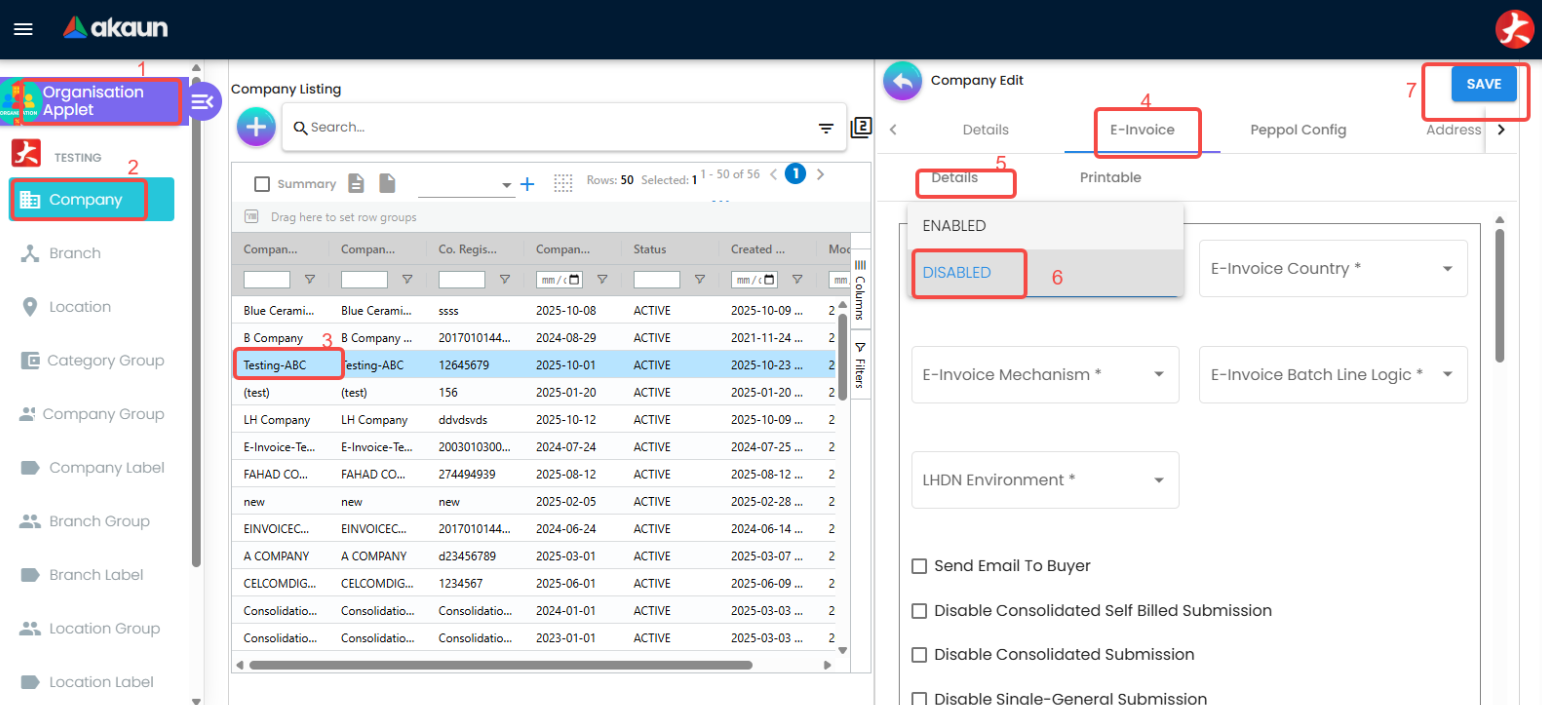

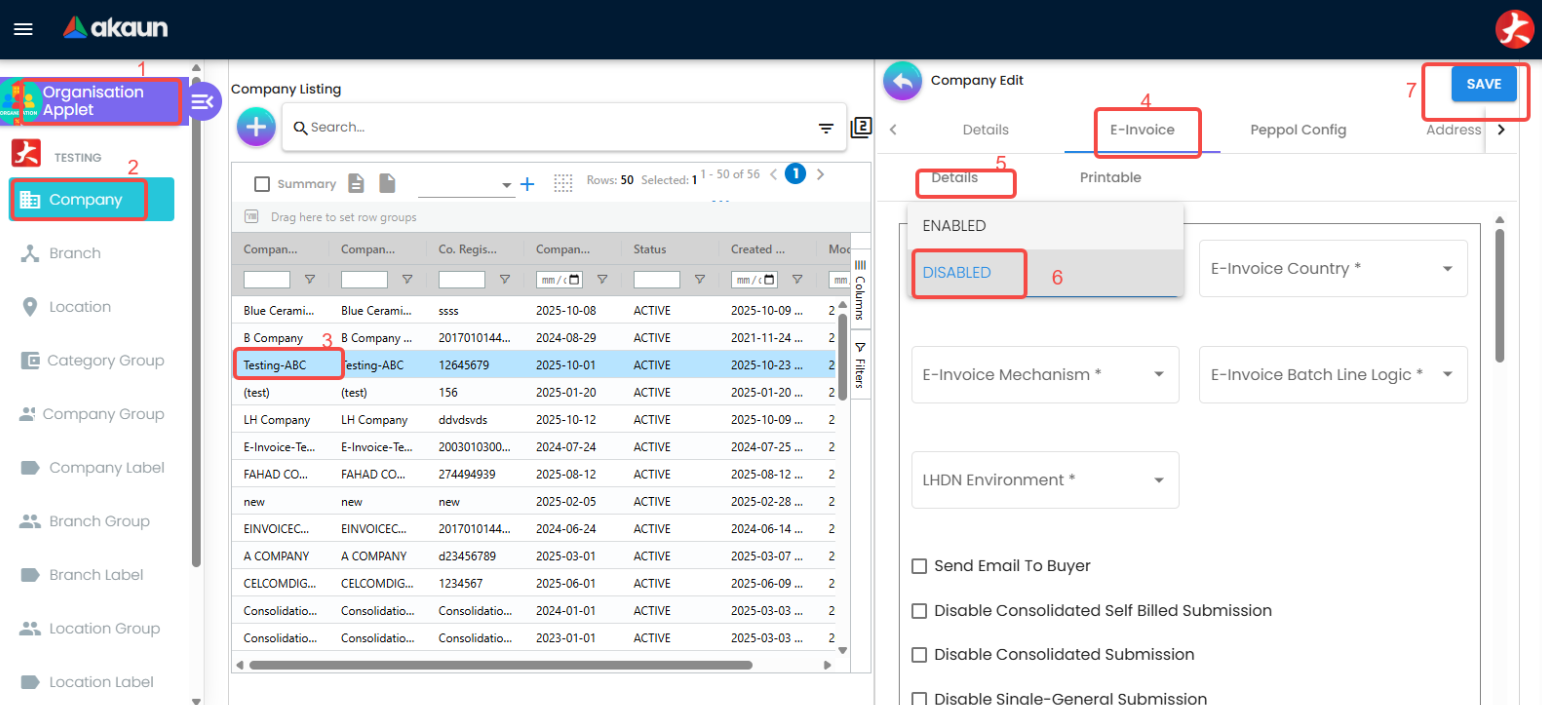

The upload is typically performed after go-live but after disabling e-invoice submission. This ensures no conflicts with automatic e-invoice submission.

Preparation

- Disable e-invoice submission for the relevant companies in the Organization Applet.

Create

OPENING BALANCEitem In Doc item maintenance applet (Service type item).Create Opening Cashbook and Opening Settlement method for each company in Cashbook Applet - this will be used for outstanding receipt voucher upload.

Export Customer outstanding from previous system / EMP

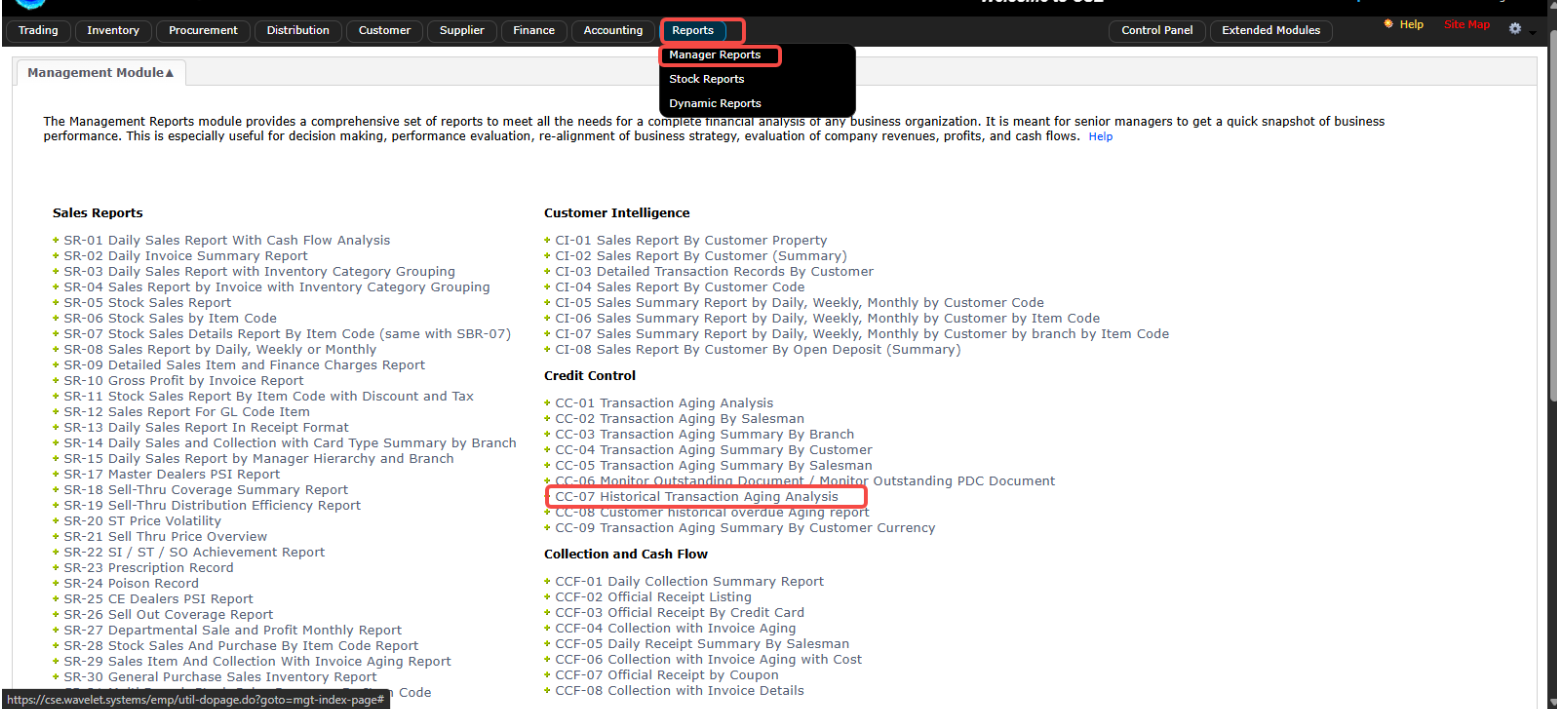

- EMP Customer:

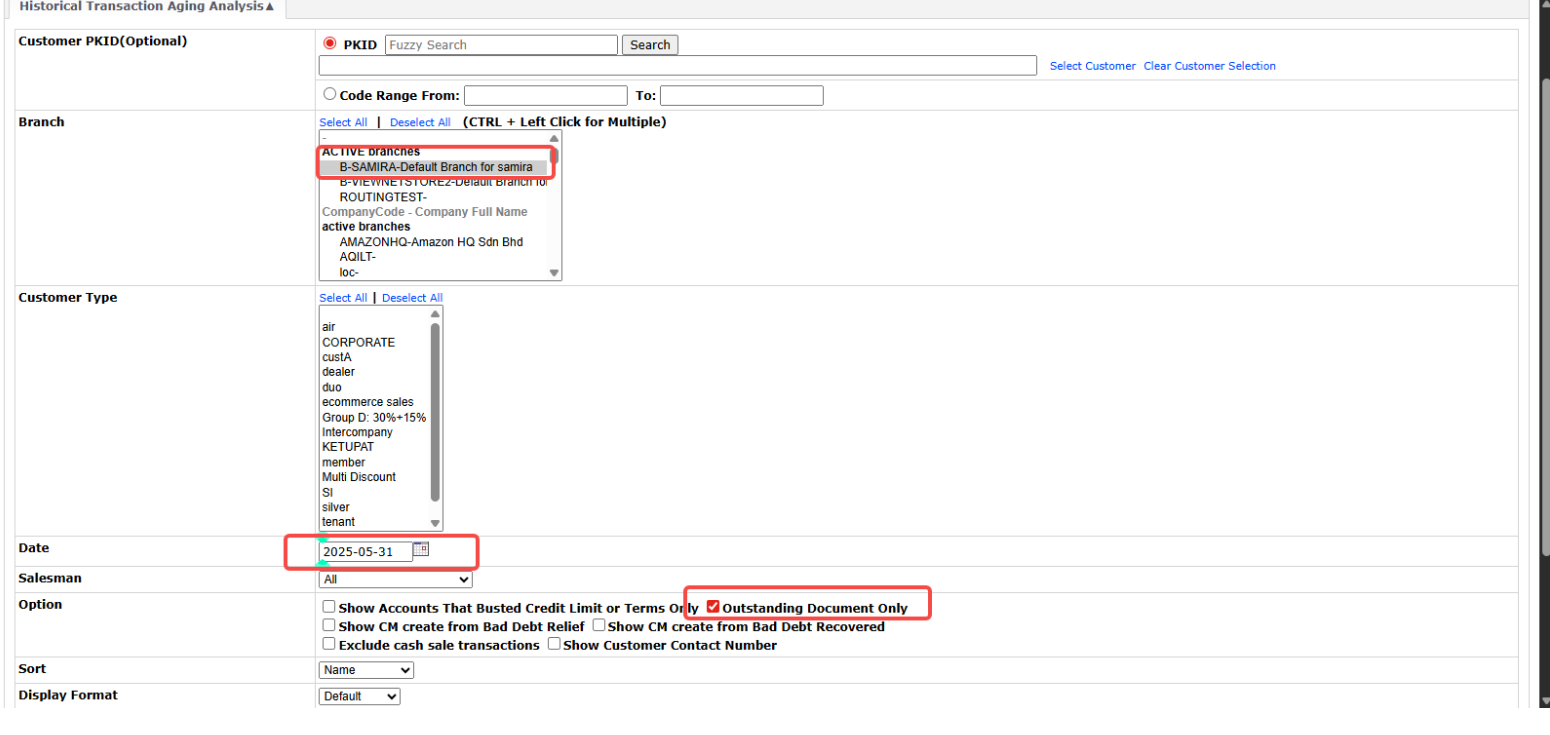

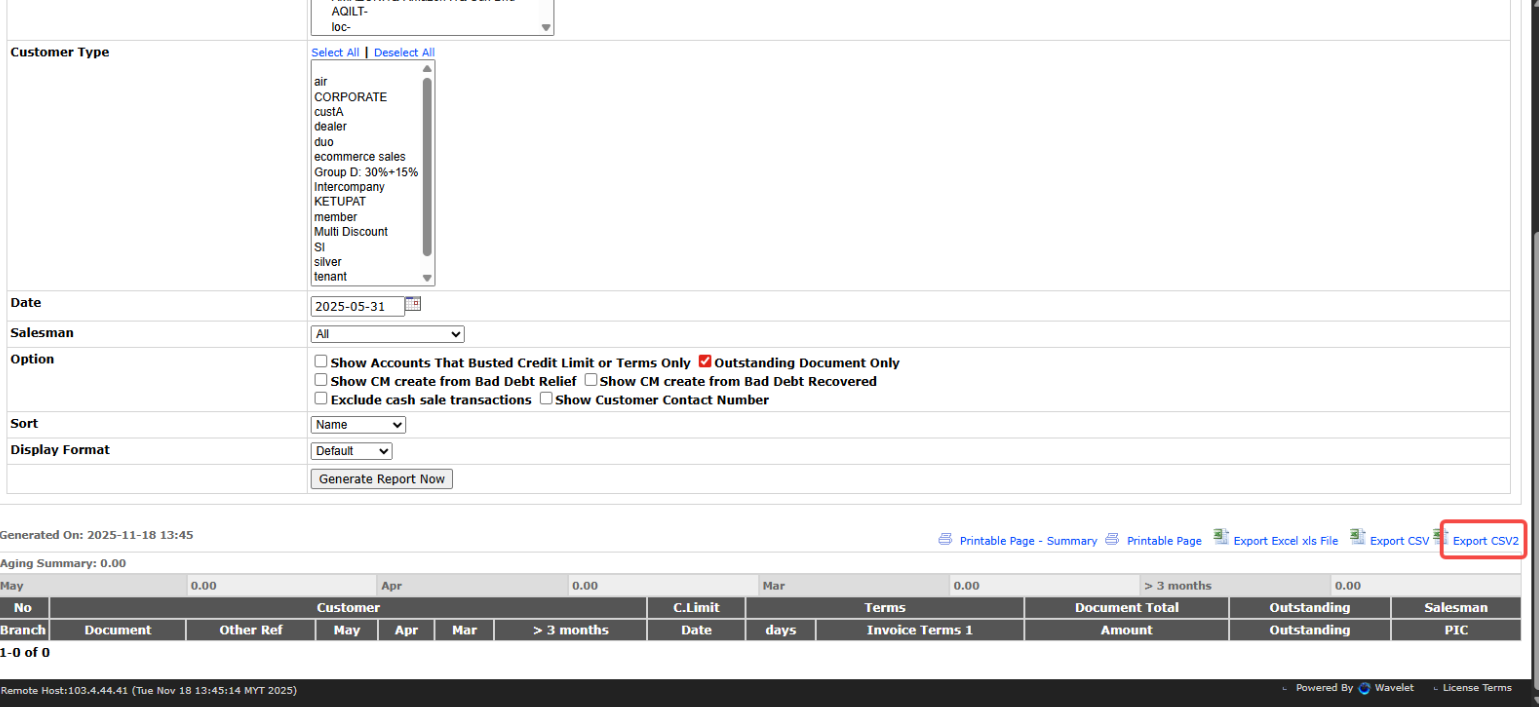

- Navigate: Reports → Manager Reports → CC-07 Historical Transaction Aging Analysis

- Select one branch

- Set data date (e.g., 31 May 2025) - closing date (cutoff date for migration)

- Export using CSV2

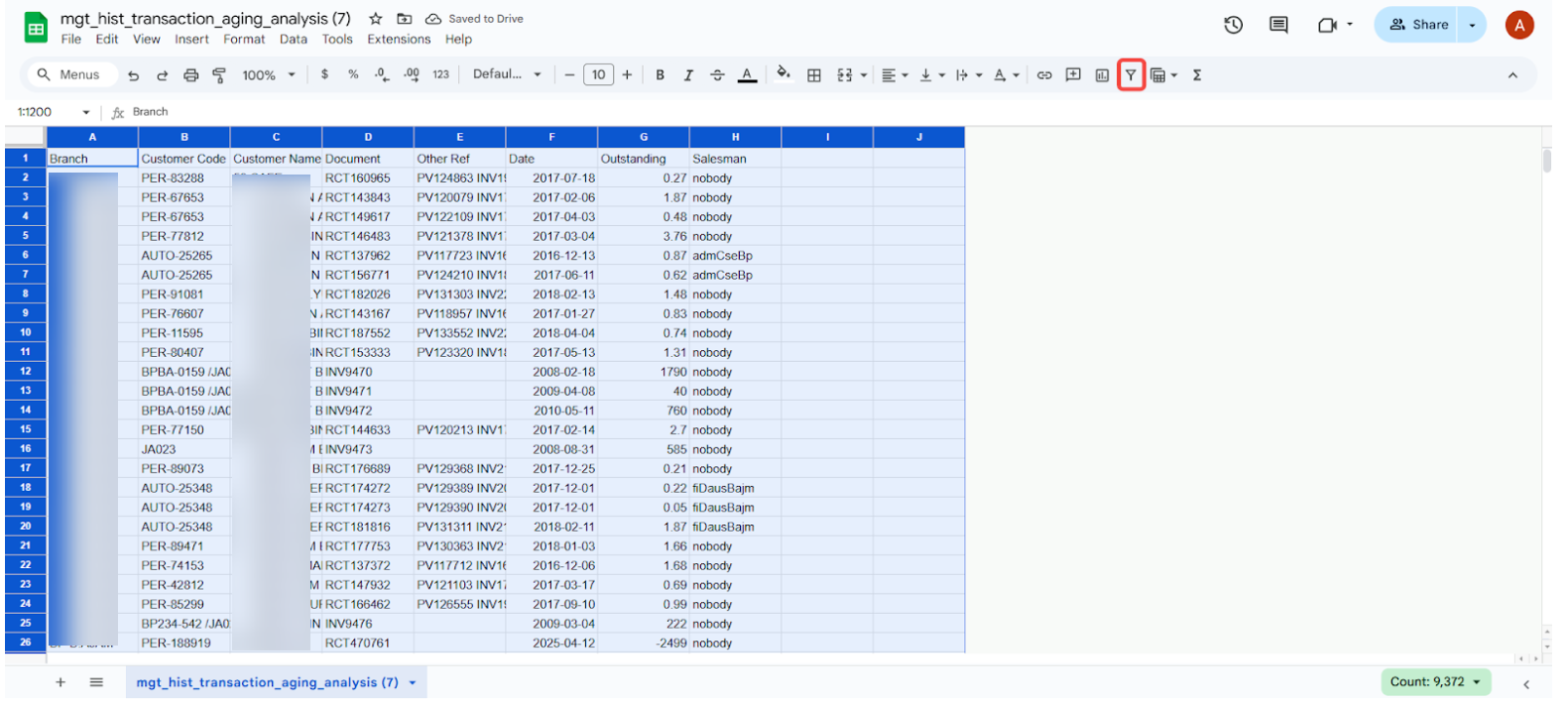

Filtering of the Data

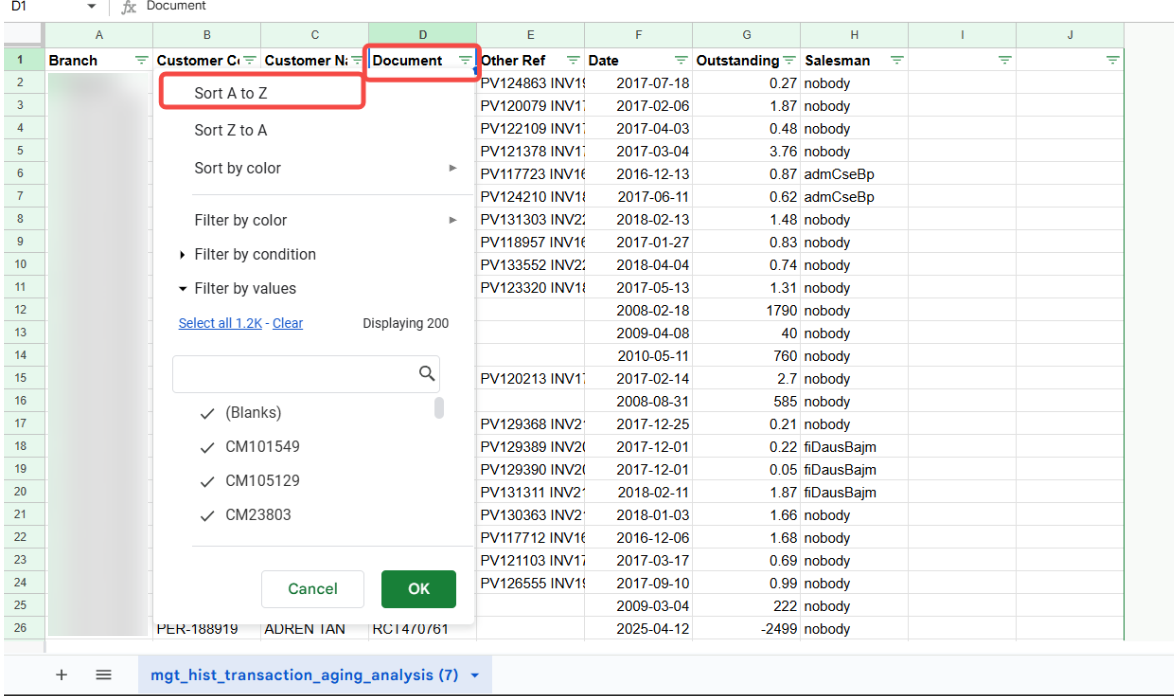

- Open CSV in Excel or Google Sheets

- Apply filters and sort Document (Column A) A → Z

- Create separate tabs for:

- Sales Invoice (Internal Sales Invoice Applet)

- Sales Credit Note (Internal Sales Credit Note Applet)

- Receipt Voucher (Internal Receipt Voucher Applet)

- Prepare upload templates for each document type.

Updating of Sales Invoice Template

Sales Invoice - Will be uploaded to Internal Sales Invoice Applet

- Branch code- Please follow the Branch code in BLG

DOC_CURRENCYalwaysMYRSETTLEMENT_OR_ITEM_CODE-OPENING BALANCEQTYalways 1UOMalwaysPCSPOSTING_STATUS-FINAL(if you putDRAFT, you need to final each doc manually in the applets)

| BRANCH_CODE | TXN_DATE | HDR_REF_NO | DOC_CURRENCY | SETTLEMENT_OR_ITEM_CODE | QTY | AMOUNT_INCL_TAX | HDR_REMARKS | ENTITY_CODE | UOM | POSTING_STATUS |

|---|---|---|---|---|---|---|---|---|---|---|

Updating of Sales Credit Note Template

Sales Credit Note - Will be uploaded to Internal Sales Credit Note Applet

- Branch code and location code- Please follow the Branch code and Location code in BLG

DOC_CURRENCYalwaysMYRSETTLEMENT_OR_ITEM_CODE-OPENING-BALANCEQTYalways 1UOMalwaysPCSPOSTING_STATUS-FINAL(if you putDRAFT, you need to final each doc manually in the applets)

| BRANCH_CODE | LOCATION_CODE | TXN_DATE | HDR_REF_NO | DOC_CURRENCY | SETTLEMENT_OR_ITEM_CODE | QTY | AMOUNT_INCL_TAX | HDR_REMARKS | ENTITY_CODE | UOM | POSTING_STATUS |

|---|---|---|---|---|---|---|---|---|---|---|---|

Mapping of the data with BLG upload template

Copy relevant columns from EMP/Previous system to Map with Upload template

- Customer Code =

ENTITY_CODE - Document Running Number =

HDR_REF_NO - Other Ref =

HDR_REMARKS - Date =

TXN_DATE - Outstanding Amount=

AMOUNT_INCL_TAX- (useABSformula to make it positive if negative amount)

- Customer Code =

Fill up the empty cells with

DEFAULTdataDelete empty columns and rows

Then the file is ready for upload, you can download it as CSV and upload to Relevant Applets

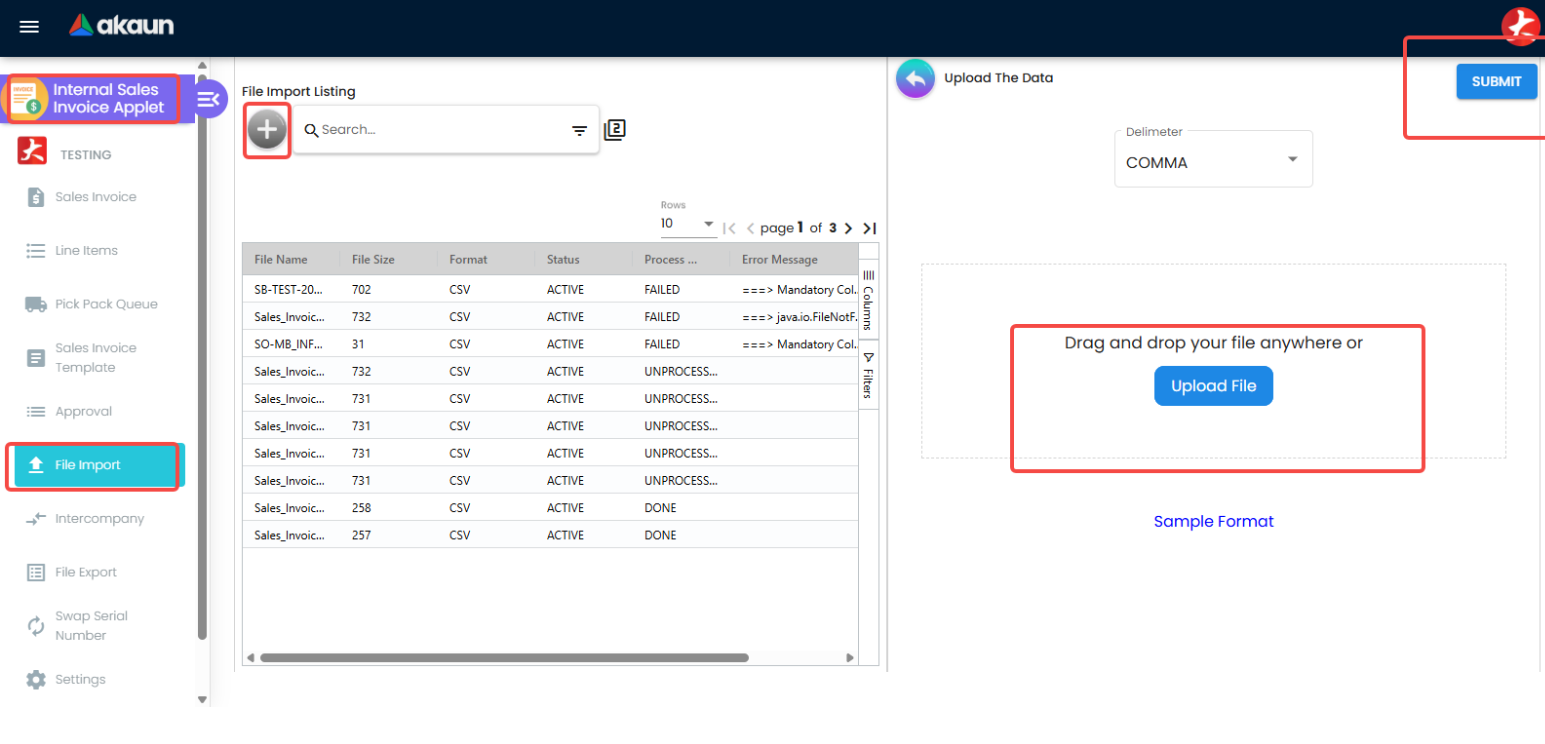

Internal Sales Invoice Applet File import

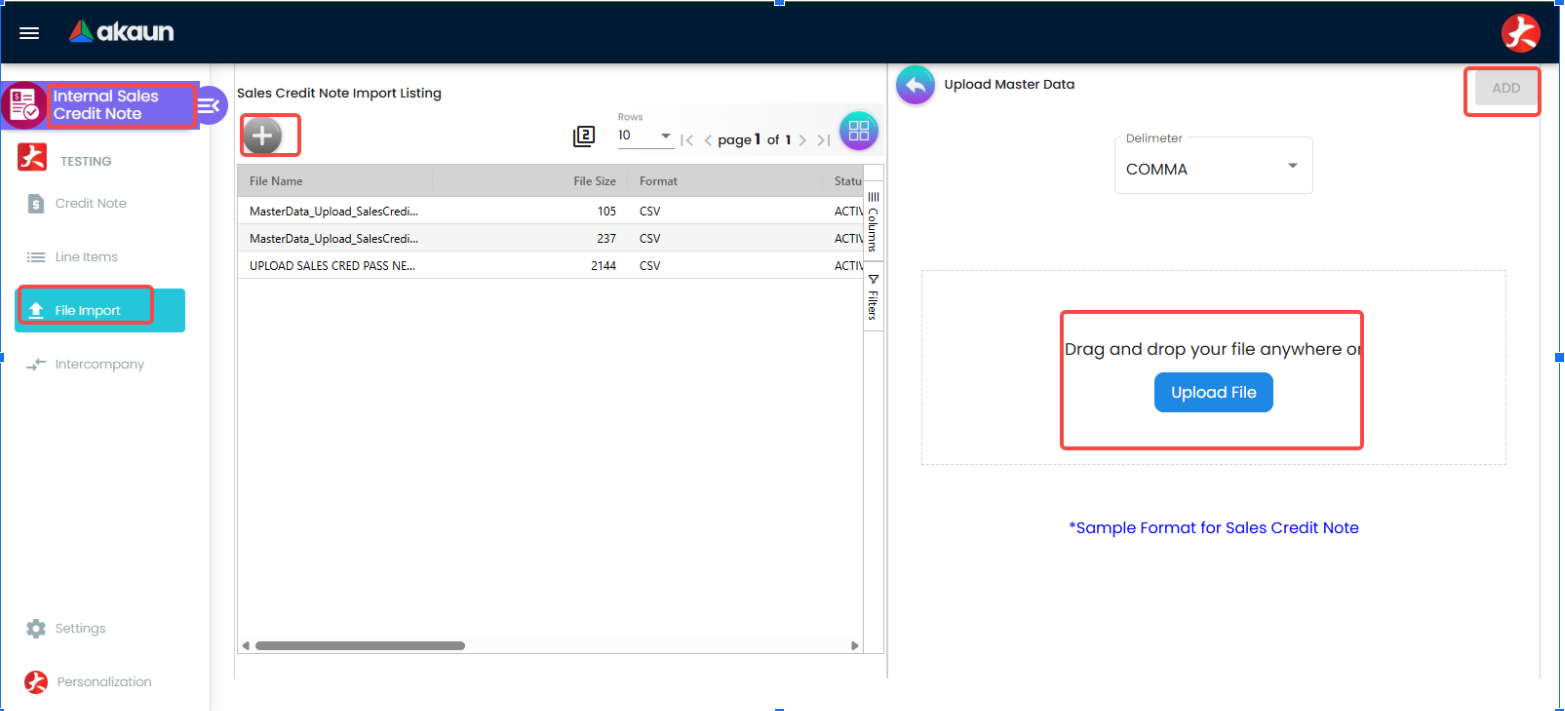

Internal Sales Credit Note Applet File import

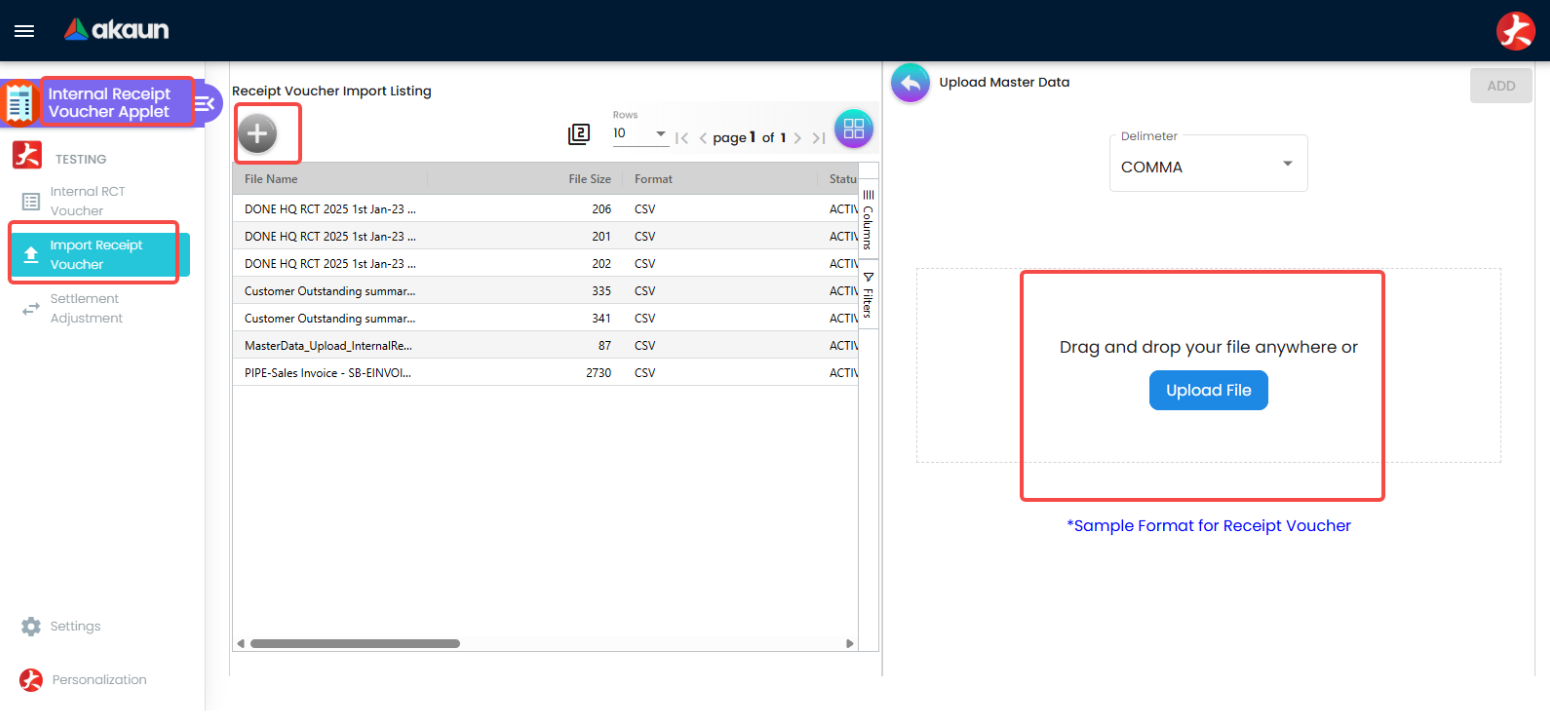

Internal Receipt Voucher Applet File import

Post-Upload Verification

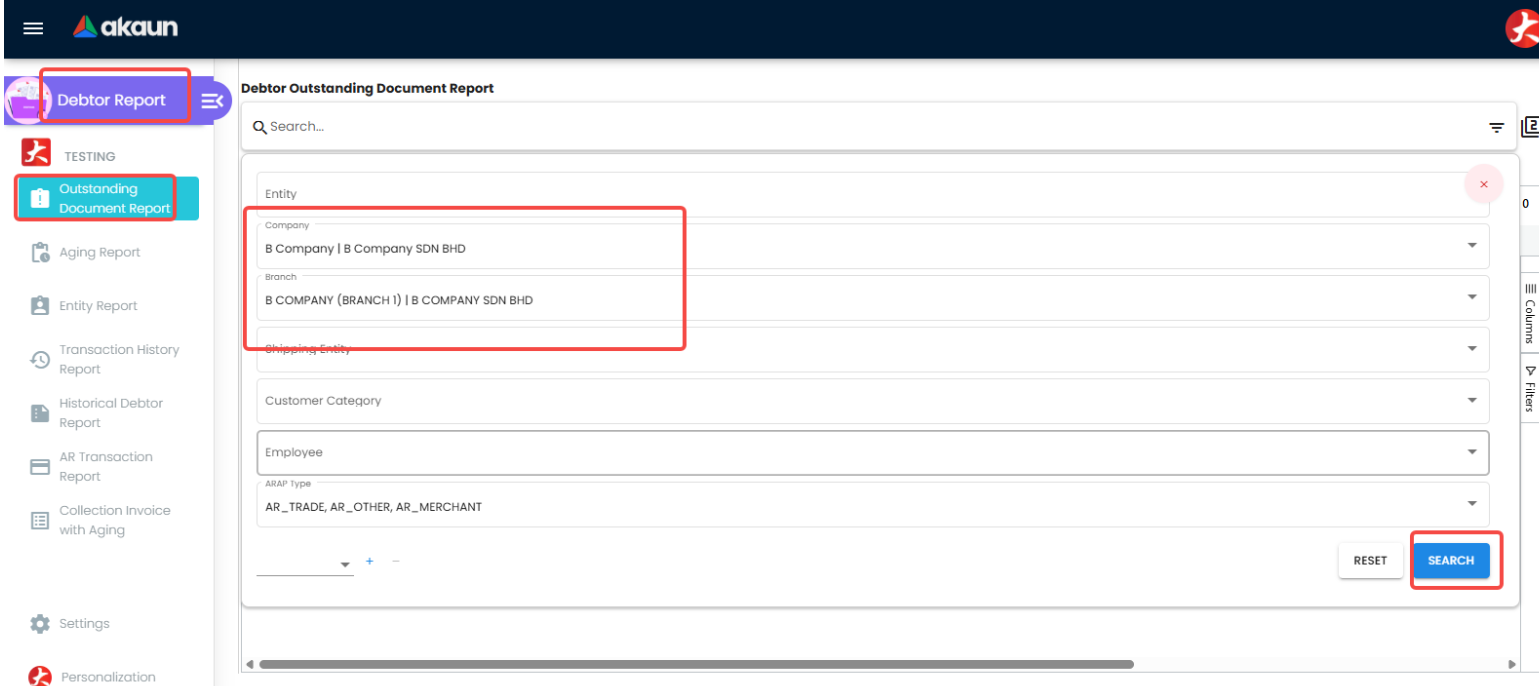

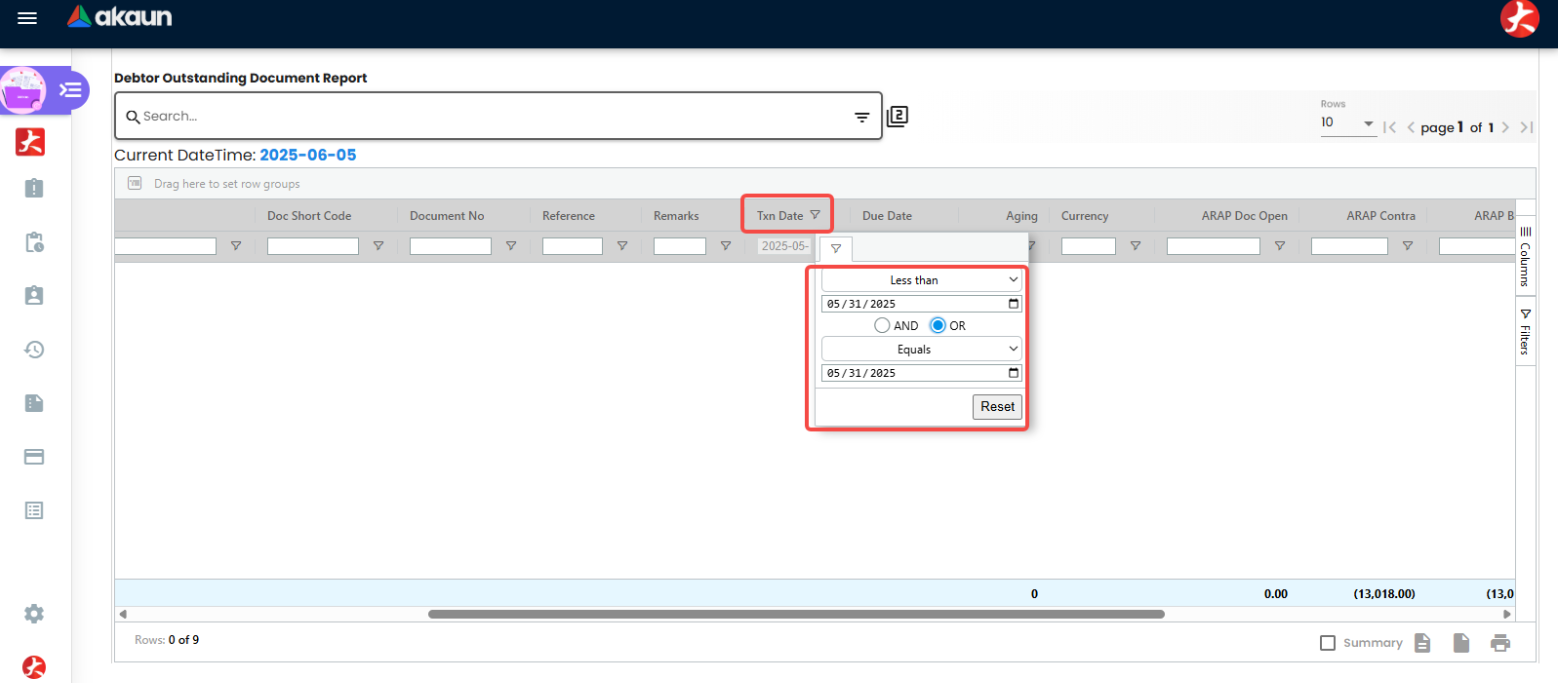

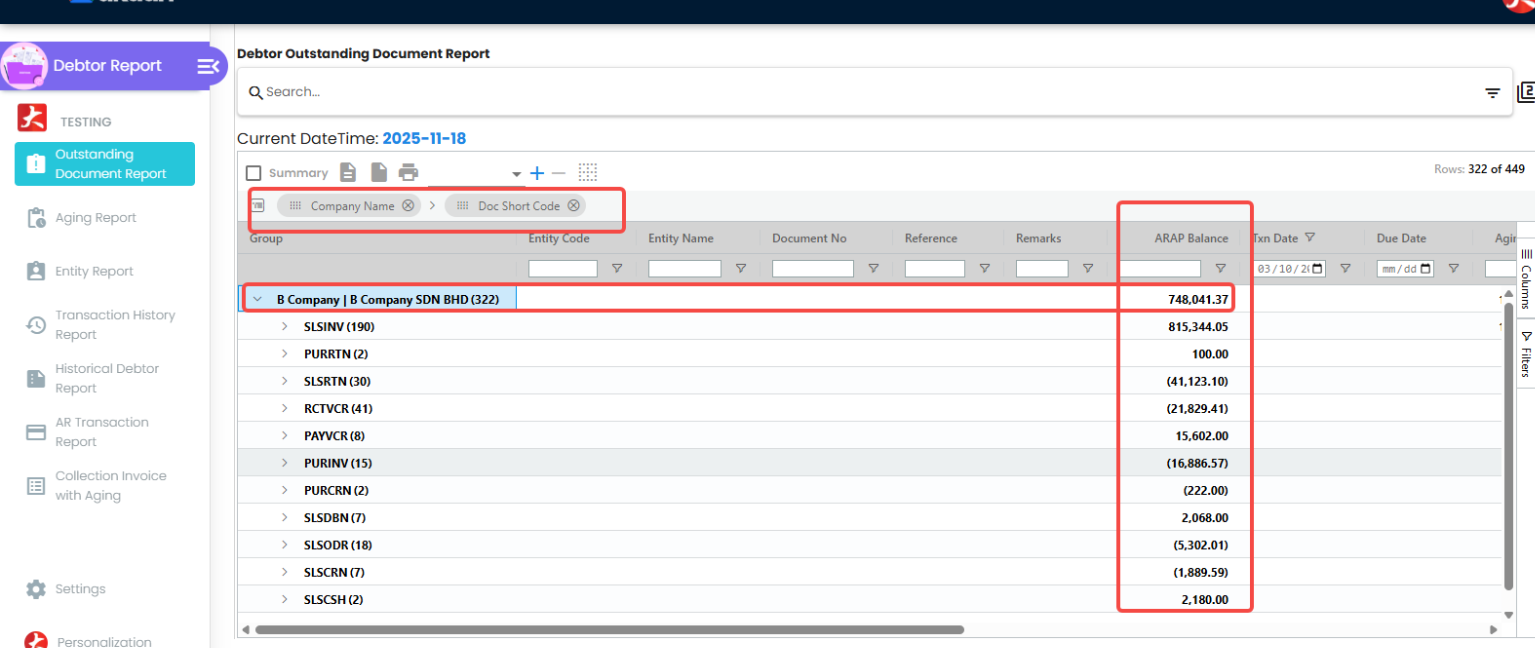

- Open Debtor Report Applet → Debtor Outstanding Document Report

- Filter by Branch

- Filter by Transaction Date

- Group by Company Code and Document Short Code

- Verify total amounts match expected opening balances.

Common Issues

- Incorrect branch/location code

- Missing customer master records

- Negative amounts not converted using (

ABS) - Posting status left as

DRAFT - Empty cells or rows in upload CSV

3. AP Balance (Supplier outstanding) Upload

Purpose

The AP Supplier Outstanding Upload process is used to bring forward supplier outstanding documents so the new system can offset any post-go-live payments against previous unpaid supplier bills.

Timing

- After receiving the final supplier outstanding listing from the previous system.

- After go-live, if suppliers continue to submit invoices late, or if final audited balances are only confirmed later.

Preparation

- Disable e-invoice submission for the relevant companies in the Organization Applet.- Only required if Supplier need self billed e-invoice

Create

OPENING BALANCEitem In Doc item maintenance applet (Service type item) - can be used same item code used for AR Balance UploadCreate Opening Cashbook and Opening Settlement method for each company in Cashbook Applet - this will be used for outstanding Payment voucher upload -can be used same settlement code used for AR Balance Upload

Export Supplier outstanding from previous system / EMP

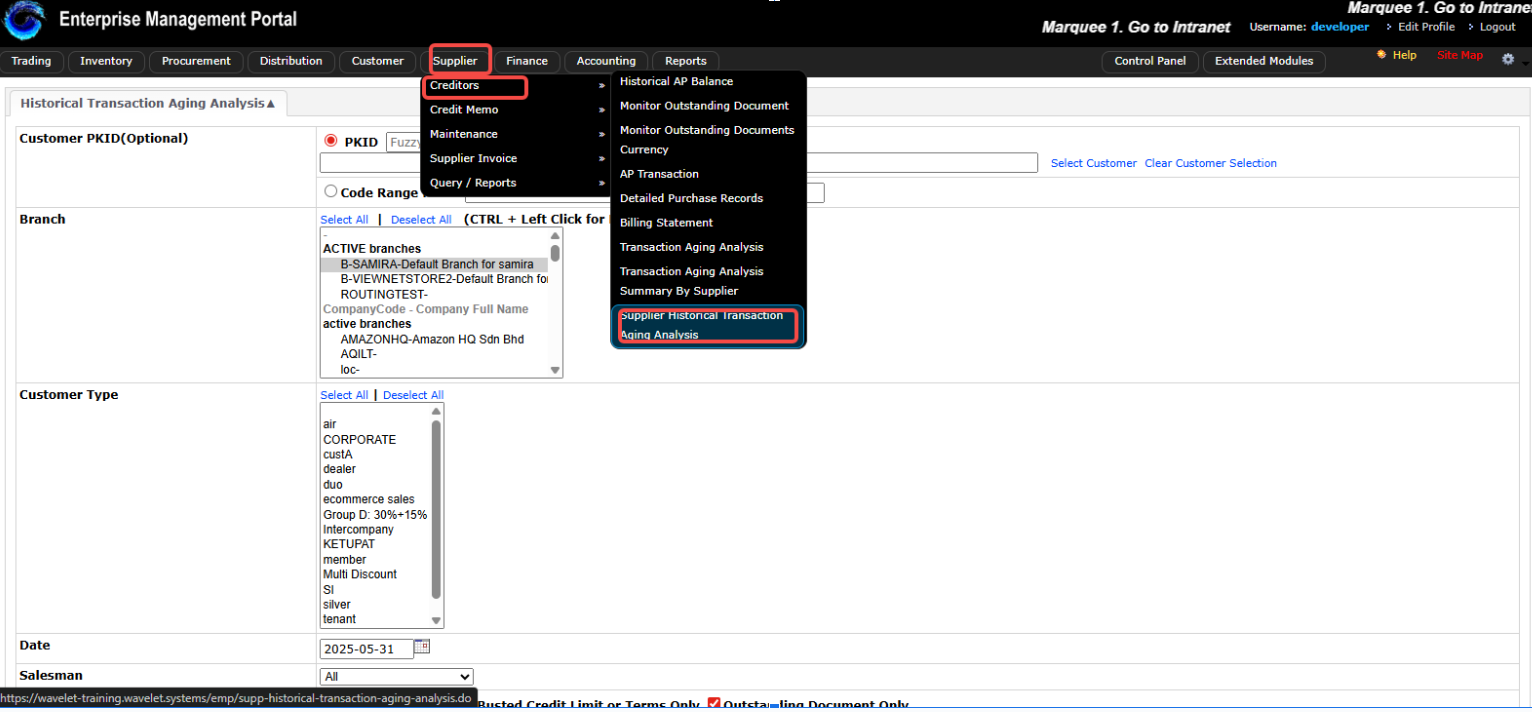

- EMP Customer:

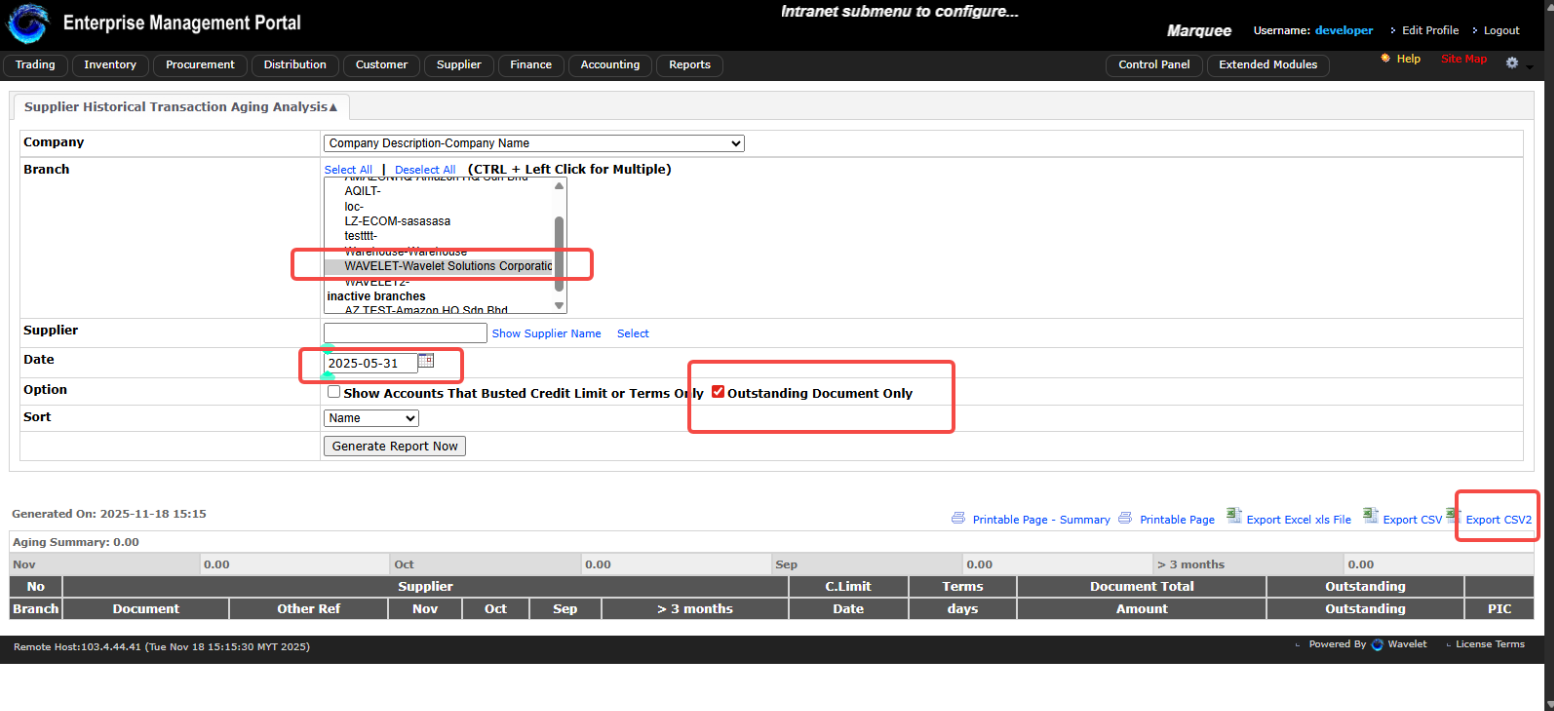

- Navigate: Supplier> Creditors>Supplier Historical Transaction Aging Analysis

- Select one branch

- Set data date (e.g., 31 May 2025) - closing date (cutoff date for migration)

- Export using CSV2

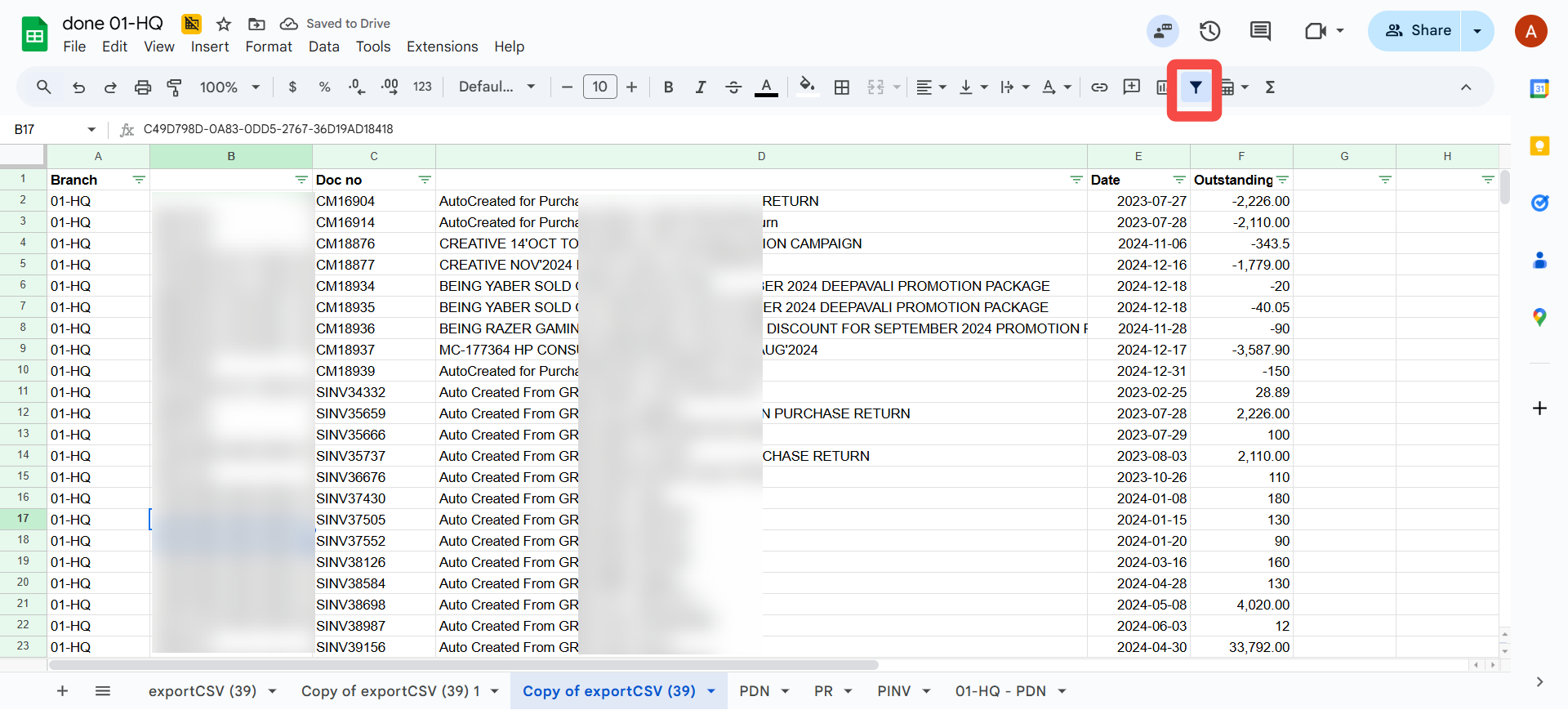

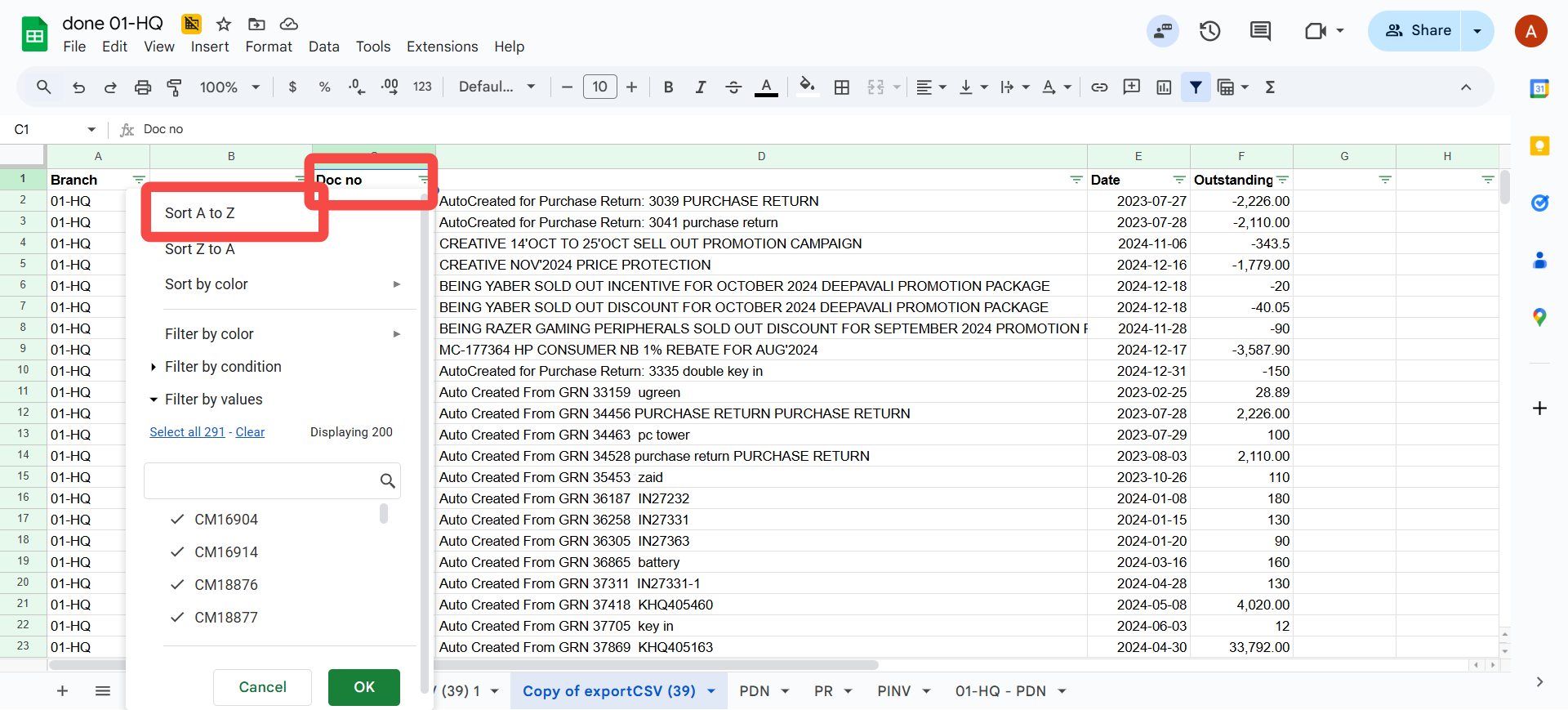

Filtering of the Data

- Open CSV in Excel or Google Sheets

- Apply filters and sort Document (Column A) A → Z

- Prepare upload templates for each document type.

Updating of PurchaseInvoice Template

Purchase Invoice - Will be uploaded to Internal Purchase Invoice Applet

- Branch code- Please follow the Branch code in BLG

DOC_CURRENCYalwaysMYRSETTLEMENT_OR_ITEM_CODE-OPENING BALANCEQTYalways 1UOMalwaysPCSPOSTING_STATUS-FINAL(if you putDRAFT, you need to final each doc manually in the applets)

| BRANCH_CODE | TXN_DATE | HDR_REF_NO | DOC_CURRENCY | SETTLEMENT_OR_ITEM_CODE | QTY | AMOUNT_INCL_TAX | HDR_REMARKS | ENTITY_CODE | UOM | POSTING_STATUS |

|---|---|---|---|---|---|---|---|---|---|---|

Updating of Purchase Debit Note Template

Purchase Debit Note - Will be uploaded to Internal Purchase Debit Note Applet

- Branch code and location code- Please follow the Branch code and Location code in BLG

DOC_CURRENCYalwaysMYRSETTLEMENT_OR_ITEM_CODE-OPENING-BALANCEQTYalways 1UOMalwaysPCSPOSTING_STATUS-FINAL(if you putDRAFT, you need to final each doc manually in the applets)

| BRANCH_CODE | LOCATION_CODE | TXN_DATE | HDR_REF_NO | DOC_CURRENCY | SETTLEMENT_OR_ITEM_CODE | QTY | AMOUNT_INCL_TAX | HDR_REMARKS | ENTITY_CODE | UOM | POSTING_STATUS |

|---|---|---|---|---|---|---|---|---|---|---|---|

Updating of Payment Voucher Template

Payment Voucher - Will be uploaded to Internal Payment voucher Applet

- Branch code - Please follow the Branch code in BLG

DOC_CURRENCYalwaysMYRSETTLEMENT_OR_ITEM_CODE-ABC-Opening cashbook(for ABC Company only)QTYalways 1UOMalwaysPCSPOSTING_STATUS-FINAL(if you putDRAFT, you need to final each doc manually in the applets)

| BRANCH_CODE | TXN_DATE | HDR_REF_NO | DOC_CURRENCY | SETTLEMENT_OR_ITEM_CODE | QTY | AMOUNT_INCL_TAX | HDR_REMARKS | ENTITY_CODE | UOM | POSTING_STATUS |

|---|---|---|---|---|---|---|---|---|---|---|

Mapping of the data with BLG upload template

Copy relevant columns from EMP/Previous system to Map with Upload template

- Customer Code =

ENTITY_CODE - Document Running Number =

HDR_REF_NO - Other Ref =

HDR_REMARKS - Date =

TXN_DATE - Outstanding Amount=

AMOUNT_INCL_TAX- (useABSformula to make it positive if negative amount)

- Customer Code =

Fill up the empty cells with

DEFAULTdataDelete empty columns and rows

Then the file is ready for upload, you can download it as CSV and upload to Relevant Applets

Integration Architecture

Transaction Flow

Source Transactions → Processing Applets → General Ledger → Financial ReportingData Dependencies

Core Module (Master Data)

↓

Transaction Processing Applets

↓

General Ledger

↓

Financial Reports & AnalyticsReal-Time Integration

- All transaction applets update the General Ledger in real-time

- Cross-module validation ensures data integrity

- Automated workflow routing based on transaction types

- Comprehensive audit trails across all processes

Performance and Scalability

High-Volume Processing

- Batch processing capabilities for large transaction volumes

- Parallel processing for improved performance

- Queue management for peak load handling

- Automated scheduling for routine processes

Scalability Features

- Horizontal scaling for growing transaction volumes

- Database partitioning for large data sets

- Caching mechanisms for frequently accessed data

- Archive strategies for historical data

Compliance and Audit

Audit Trail Features

- Complete transaction history tracking

- User activity logging

- Approval workflow documentation

- Change tracking and versioning

- Comprehensive reporting capabilities

Compliance Support

- Multi-standard accounting compliance (GAAP, IFRS, etc.)

- Regulatory reporting capabilities

- SOX compliance features

- Industry-specific compliance support

- Real-time monitoring and alerting

Related Documentation

Setup and Configuration

- Accounting Module Implementation Guide - TODO: Create comprehensive implementation guide

- Transaction Processing Best Practices - TODO: Create best practices guide

- Multi-Entity Accounting Setup - TODO: Create multi-entity guide

Advanced Topics

- Complex Transaction Processing - TODO: Create advanced guide

- Performance Optimization

- Compliance and Audit

Training Materials

- Accounting Module User Training - TODO: Create user training materials

- Transaction Processing Workflows - TODO: Create workflow documentation

- Troubleshooting Guide - TODO: Create troubleshooting guide

Next Steps

After implementing the Accounting Module:

- Complete Core Module setup as prerequisite

- Configure transaction processing applets in phases

- Set up approval workflows for each transaction type

- Train accounting teams on new processes

- Establish monitoring and reporting procedures

- Optimize performance based on usage patterns

- Implement advanced features as business grows